How Do I Avoid Common Mistakes When Trading Cryptocurrencies?

Avoid cryptocurrency trading mistakes with our 2026 psychology guide. Learn 14 common errors, emotional trading traps, risk management, and discipline strategies.

Cryptocurrency trading mistakes follow predictable patterns—emotional decision-making, inadequate risk management, and impulsive actions rooted in psychological biases. These mistakes are not technical failures but psychological ones. This comprehensive guide identifies 15 critical trading mistakes, explains why they occur (psychological underpinnings), quantifies their costs, and provides specific prevention strategies. Success in cryptocurrency trading depends not on market prediction ability but on psychological discipline and systematic risk management—two qualities independent of market knowledge but entirely within trader control.

Understanding Cryptocurrency Trading Psychology

Critical Insight: Cryptocurrency trading is fundamentally a psychology game, not a technical one. Markets reward discipline over intelligence. Knowledge without emotional control creates costly losses. Discipline without perfect knowledge produces consistent profits.

The cryptocurrency market exploits psychological weaknesses systematically. Market structure creates emotional extremes:

- 24/7 trading generates urgency and time pressure

- Extreme volatility triggers fear and greed simultaneously

- Social media amplifies FOMO and creates information cascades

- Leverage transforms small mistakes into catastrophic losses

- Speed advantages reward impulsivity and punish deliberation

Two Brain Systems in Conflict:

Your limbic system (emotion-driven, survival-focused, reactive) battles your prefrontal cortex (logic-driven, planning-focused, deliberative). Cryptocurrency markets activate limbic system responses—evolutionary programming designed for physical survival creates terrible financial decisions in modern markets.

Most traders fail not from lack of knowledge but from inability to execute knowledge under emotional stress. Technical analysis skills mean nothing if emotions override rational decisions.

Mistake 1: Trading Without a Defined Strategy

The Problem:

Entering trades based on random opportunity, social media tips, or price action patterns without a coherent framework. Most traders buy reactively when seeing prices rise, sell reactively when seeing prices fall, with no connection to underlying analysis.

Why It Happens:

- Excitement overrides planning

- Social media creates urgency ("Buy NOW")

- FOMO triggers impulsive entry

- Overconfidence in ability to catch moves

- Lack of experience understanding strategy value

Cost Impact:

Studies show traders without documented strategies underperform those with strategies by 40-60% annually. Every emotion-driven trade includes hidden costs: decision fatigue, missed opportunities, second-guessing.

Prevention:

- Write down your strategy: Entry criteria, exit criteria, position sizing, maximum loss per trade

- Define trade types: What constitutes a valid setup for you specifically?

- Establish rules: What conditions allow trading? What conditions require staying on sidelines?

- Document reasoning: Why this strategy? What research supports it?

- Test strategy first: Paper trade (simulate without money) for 2-4 weeks before real capital

Implementation: Before opening any position, ask: "Does this setup meet my documented criteria?" If answer is no, DON'T trade.

Mistake 2: Emotional Trading (Fear and Greed)

The Problem:

Making trading decisions based on emotional state rather than market analysis. Selling in panic when prices drop (fear), buying when prices surge (greed). This is the #1 wealth destroyer in trading.

Why It Happens:

- Brain's threat detection system evolved for physical danger

- Price losses trigger fight-flight-freeze responses

- Neurochemicals (cortisol from fear, dopamine from wins) cloud judgment

- Mirror neurons cause herd mentality—seeing others sell triggers selling

Real Example:

Bitcoin crashes 20% → Fear triggers massive selling → Traders sell at $75,000 who should hold. Price recovers to $95,000 one week later. Original sellers now buy back at higher price (locking in loss permanently).

Cost Impact:

Average emotional trader loses 50-70% annually. One panic sale at market bottom can eliminate 3-5 years of gains.

Prevention:

- Create decision rules BEFORE emotions arise: Predetermined entry, exit, stop-loss (not during market action)

- Use automation: Set stop-loss orders immediately upon entry

- Implement circuit breakers: If you've lost 5% daily, stop trading for rest of day

- Practice meditation/breathing: Literal neurological techniques reduce amygdala activation

- Remove trade-enabling tools during emotional periods: Close trading app if stressed

- Reframe losses: Losses are data points, not personal failures

Specific Technique: When feeling urge to panic sell, literally step away from device for 30 minutes. Reread your original investment thesis. Most urges pass with time.

Mistake 3: Overleveraging (Margin Trading)

The Problem:

Using borrowed capital to amplify potential gains. While leverage magnifies profits during winning trades, it obliterates capital during losing ones. Leverage creates liquidation risk—positions close automatically at worst possible times.

2025 Reality:

Leverage trading causes 80%+ of catastrophic trader losses. A 50% price decline (Bitcoin $100K → $50K is possible) = 100% loss on 2x leverage = 200% loss on 4x leverage (means bankruptcy).

Why Traders Use Leverage:

- Desire for quick riches

- Underestimation of risk

- Overconfidence in prediction ability

- Seeing others succeed with leverage

Prevention:

- Rule: Start with zero leverage. Trade spot (your own money) exclusively for first 1-2 years

- If using leverage eventually: Maximum 2x, only on strongest setups, only with 10% account risk per trade

- Never use leverage in high volatility: Altcoins >10% daily swings = no leverage

- Set stop-loss BEFORE entering leveraged trade: Non-negotiable

- Calculate liquidation price: Know at what price position auto-closes

Mental Shift Required: Leverage doesn't accelerate learning—it accelerates bankruptcy. Patient traders who compound through spot trading dramatically outperform leveraged traders who take catastrophic losses.

Mistake 4: FOMO-Driven (Fear of Missing Out) Trading

The Problem:

Buying cryptocurrencies because prices are surging, social media is buzzing, influencers are promoting, and fear of missing opportunity overcomes rational analysis. Buying at peaks due to psychological pressure.

Why It's Devastating:

By the time FOMO triggers widespread buying, early investors have already profited. Late buyers buy at peak prices, immediately lose 30-50%, panic sell. Classic "buy high, sell low."

2025 Data:

Token launch altcoins with massive buzz typically crash 80%+ within 1-3 months. Peak FOMO buyers lose 90%+ of capital.

Red Flags for FOMO:

- Coin's price already +200-500% recent weeks

- Celebrities/influencers heavily promoting

- Trading volume 100x normal (unsustainable)

- Social media dominated by "last chance" mentality

- Unrealistic promises ("next Bitcoin," "guaranteed 10x")

Prevention:

- Create FOMO protocol: If you feel urgency to buy, implement 24-hour waiting period before acting

- Ban social media price checking: Limit Twitter/Discord crypto channels to 30 minutes daily maximum

- Unfriend/unfollow crypto influencers: Their job is selling hopium, not accurate analysis

- Ask three questions before buying:

- Does this fit my strategy criteria?

- Would I still buy this if price was flat for 6 months?

- What's the legitimate use case (beyond price appreciation)?

- Never buy newly launched tokens: Wait 3-6 months minimum to see if project survives

- Calculate entry price ratio: If buying after +100% move, position size should be 25% normal size (higher risk = smaller position)

Key Insight: Money made during bubbles = money taken FROM less-informed traders. Don't volunteer to be that trader.

Mistake 5: Inadequate Risk Management

The Problem:

Failing to define maximum acceptable loss per trade or portfolio-wide. Risk management separates profitable traders from bankrupt ones. Without it, one bad trade destroys entire year's gains.

Specific Errors:

- No stop-loss on any trades

- Position sizing ignores account size (risking 10-20% per trade)

- No portfolio-level limits (individual trades exceed daily loss limit)

- Holding losing trades "hoping for recovery"

- Revenge trading (doubling down after losses)

Prevention Framework:

- Personal Risk Tolerance: Maximum portfolio loss you emotionally tolerate = X%

- Daily Limit: If lost X% daily, stop trading immediately for that day

- Per-Trade Risk: Never risk more than 1-2% of portfolio on single trade

- Formula: (Portfolio Size × 0.02 / Distance to Stop-Loss) = Position Size

- Portfolio Diversification: Maximum 15% in any single cryptocurrency

- Position Sizing by Risk: Higher risk trades (small cap, new projects) = smaller positions

- Mandatory Stop-Losses: Set at entry, adjust only upward

Example:

$10,000 portfolio × 2% risk = $200 max loss per trade

If Bitcoin stop-loss is $1,000 away, position size = $200/$1,000 = 0.02 Bitcoin = $0.20 at Bitcoin $100K price

Mistake 6: Overtrading (Too Many Trades)

The Problem:

Executing excessive trades driven by boredom, desire to recover losses, or overconfidence. More trades = higher fees, more decision points, more emotional stress, more mistakes.

Reality Check:

Active day traders underperform passive investors by 50-70%. Frequent trading kills returns through:

- Trading fees (0.1-0.25% per trade)

- Spread costs (gap between buy/sell prices)

- Taxes (short-term capital gains at highest rates)

- Emotional exhaustion leading to poor decisions

Warning Signs of Overtrading:

- More than 5 trades weekly

- Checking prices more than 3 times daily

- Making trades during emotional periods

- "Revenge trading" after losses

- Trading just because market is open

Prevention:

- Limit trade frequency: Maximum 2-3 trades per week

- DCA strategy: Dollar-Cost Averaging (regular purchases regardless of price) beats frequent trading

- Create trading calendar: Designate specific days for analyzing new opportunities

- Automate purchases: Schedule purchases weekly/monthly removes emotional decision-making

- Track per-trade costs: Document all fees—seeing total often triggers behavior change

- Ban trading during stress: If angry/upset/tired, markets stay closed

Key Principle: Successful investing is boring. Excitement = danger signal.

Mistake 7: Insufficient Research and Due Diligence

The Problem:

Investing in cryptocurrencies without understanding projects, teams, or technology. Buying based on tip rather than analysis. This represents majority of retail trader losses.

Due Diligence Checklist:

Technology Assessment:

- Read whitepaper (if incomprehensible, skip the project)

- Assess team: developers' GitHub activity, prior experience, credibility

- Code review: Is code open-source? Audited? By whom?

- Consensus mechanism: Proof of Work vs Proof of Stake vs other trade-offs?

Tokenomics Analysis:

- Total supply: Fixed or unlimited inflation?

- Distribution: What % to founders/early investors? Vest schedule?

- Utility: What actual use does token have?

- Market cap vs TVL: For DeFi, is value proportional to actual usage?

Community and Adoption:

- Active developer engagement?

- Genuine community or synthetic followers?

- Partnerships: Real enterprise adoption or marketing claims?

- Social metrics vs fundamentals: Huge Twitter following ≠ actual project quality

Risk Factors:

- Regulatory uncertainty?

- Technical risks?

- Competition from superior alternatives?

- Team risks (centralization, key-person risk)?

Verification Methods:

- Never rely on social media claims

- Use multiple data sources: CoinGecko, Messari, on-chain data

- Cross-reference info from 3+ independent sources

- Check claims on GitHub and blockchain directly

- Test product yourself (if applicable)

Mistake 8: Lack of Exit Plan

The Problem:

Entering position with target profit but no corresponding exit plan. Holding through bull market peaks hoping for higher prices, then losing majority of gains during correction. Paralysis from indecision creates losses.

Why This Happens:

- Greed: "Maybe it'll go higher"

- Regret aversion: Fear of missing gains exceeds fear of losing them

- No predetermined exit: No forcing function to take profits

- Loss aversion: Holding losers too long hoping for recovery

Prevention:

Before entering trade, answer:

- Profit target: At what price do I take profits? (e.g., +30%)

- Stop-loss: At what price do I accept loss? (e.g., -10%)

- Time-based exit: If position unchanged after X time, exit anyway?

- Rebalancing triggers: If cryptocurrency becomes >20% portfolio, trim it?

- Market cycle exit: At what price do I consider selling in bull market peak?

Exit Strategy Examples:

- "Sell 50% at +50% gain, let remainder ride to +150%"

- "Sell 25% every time price doubles"

- "Hold 2-3 years maximum, then reassess"

- "Sell if fundamentals deteriorate"

Critical: Write exit plan at entry. Emotional state improves dramatically knowing exit strategy in advance.

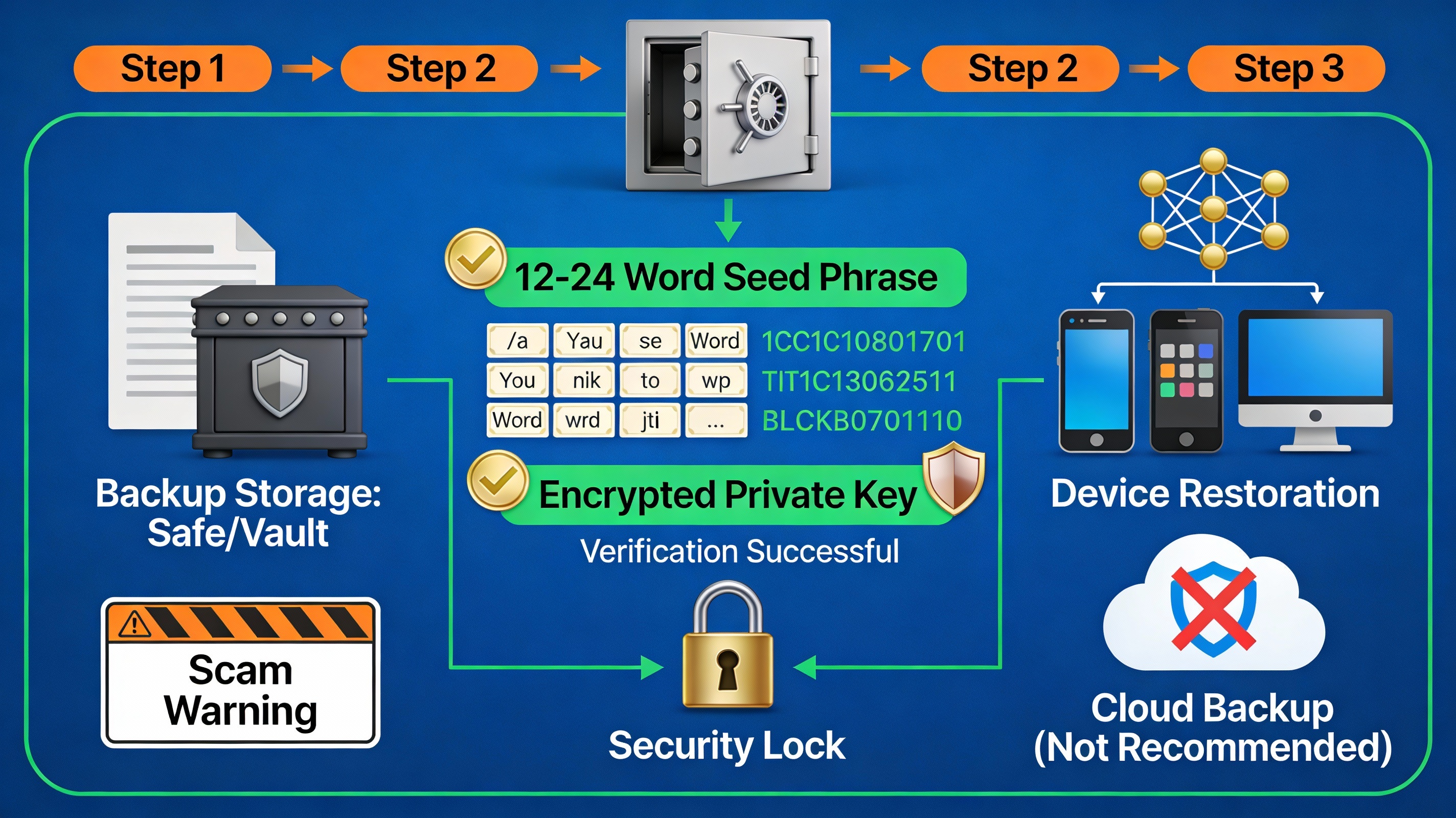

Mistake 9: Neglecting Security

The Problem:

Storing cryptocurrency on exchanges, using weak passwords, ignoring 2FA, clicking suspicious links. Security lapses result in permanent loss—unlike stocks, no recovery mechanism exists.

2025 Reality:

Exchange hacks, wallet compromises, and phishing attacks steal $3-5 billion annually. Once stolen, funds are gone forever.

Prevention:

- Never store significant holdings on exchanges: Exchanges are targets and can be compromised

- Use hardware wallets for holdings: Ledger, Trezor for assets held >6 months

- Enable 2FA on everything: 2FA codes via authenticator app (never SMS—text interception possible)

- Backup seed phrases properly: Multiple physical backups in secure locations

- Never share credentials: If customer service asks for password, they're scammers

- Verify URLs directly: Don't click links; type addresses manually

- Test recovery process: Before needing it, verify your seed phrase actually restores wallet

Mistake 10: Ignoring Taxes

The Problem:

Active traders often face tax bills exceeding annual profits, creating insolvency. Failing to track basis, wash sales, and transaction history creates audit nightmares.

India-Specific:

- Every crypto transaction creates taxable event

- Short-term capital gains taxed at slab rates (30-42%)

- Long-term (>2 years) taxed at 20% with indexation benefit

- Staking rewards taxable as income

- DeFi/margin interest taxable

Prevention:

- Use tax software: Tools like CoinTracker, Koinly automate calculation

- Track cost basis: Document purchase price/date for every transaction

- Segregate accounts: Keep trading separate from long-term holdings for clarity

- Consult tax pro: CPA familiar with crypto saves money on taxes

- Plan trading frequency: Consider tax impact before deciding day trading vs investing

Mistake 11: Following Fake Experts/Influencers

The Problem:

Copying trades from social media figures whose interests diverge from yours. Influencers profit from engagement/pumping coins, not helping followers. Many are paid pumpers.

Why It's Dangerous:

- Influencer promotes coin → followers buy → price pumps → influencer sells at peak → followers left holding at high prices

- Position timing differs: influencer bought early, you're buying after pump

- Risk tolerance differs: influencer can afford massive losses; you can't

- Conflicts of interest: Most crypto influencers paid to promote certain projects

Prevention:

- Never follow "trading signals": Unsubscribe from Telegram signal groups immediately

- Question influencer motivation: If they're selling something (course, signals), they profit from your decisions

- Verify claims independently: Don't trust any claim without personal research

- Calculate real performance: Many influencers cherry-pick winners, hide losers

- Build own analysis skills: The only reliable expert is your own analysis

Mistake 12: Trading With Unaffordable Money

The Problem:

Using money needed for bills, emergencies, or life goals. When stressed about meeting obligations, emotional trading becomes destructive.

Prevention:

- Emergency fund first: 6 months expenses in stable assets before trading any money

- Rule of no:" Never risk money you're uncomfortable losing completely

- Position size to life goals: If apartment down payment in 3 years, don't invest that money in crypto

- Stress test portfolio: If Bitcoin -50%, would you still be okay? If no, position too large

Mistake 13: Concentration Risk (All Eggs in One Basket)

The Problem:

Putting entire portfolio in single cryptocurrency or small set of correlated assets. One project failure = portfolio destruction.

Prevention:

- Maximum 15-20% any single cryptocurrency

- Diversify across categories: Store-of-value (Bitcoin), Smart contracts (Ethereum), Alternative L1 (Solana), DeFi, Layer 2, etc.

- Allocate % by conviction level: High conviction = 15%, medium conviction = 10%, speculative = 5%

Mistake 14: Poor Timing Trying to "Call the Bottom"

The Problem:

Attempting to buy at market bottoms or sell at tops. Human ability to predict exact reversals = zero. Investors lose 60% of gains waiting for better entries.

Prevention:

- Use DCA strategy (Dollar-Cost Averaging)

- Buy fixed amount weekly regardless of price

- Removes timing pressure

- Research shows DCA outperforms "trying to time" by 30-40%

Comments 0

Most Read

What Is the Concept of Tokenization in Blockchain?

Bitcoin & Ethereum Market Momentum Update

Recommended Post

What Is the Concept of Tokenization in Blockchain?

How Do I Avoid Common Mistakes When Trading Cryptocurrencies?

How Do I Recover a Lost Cryptocurrency Wallet?

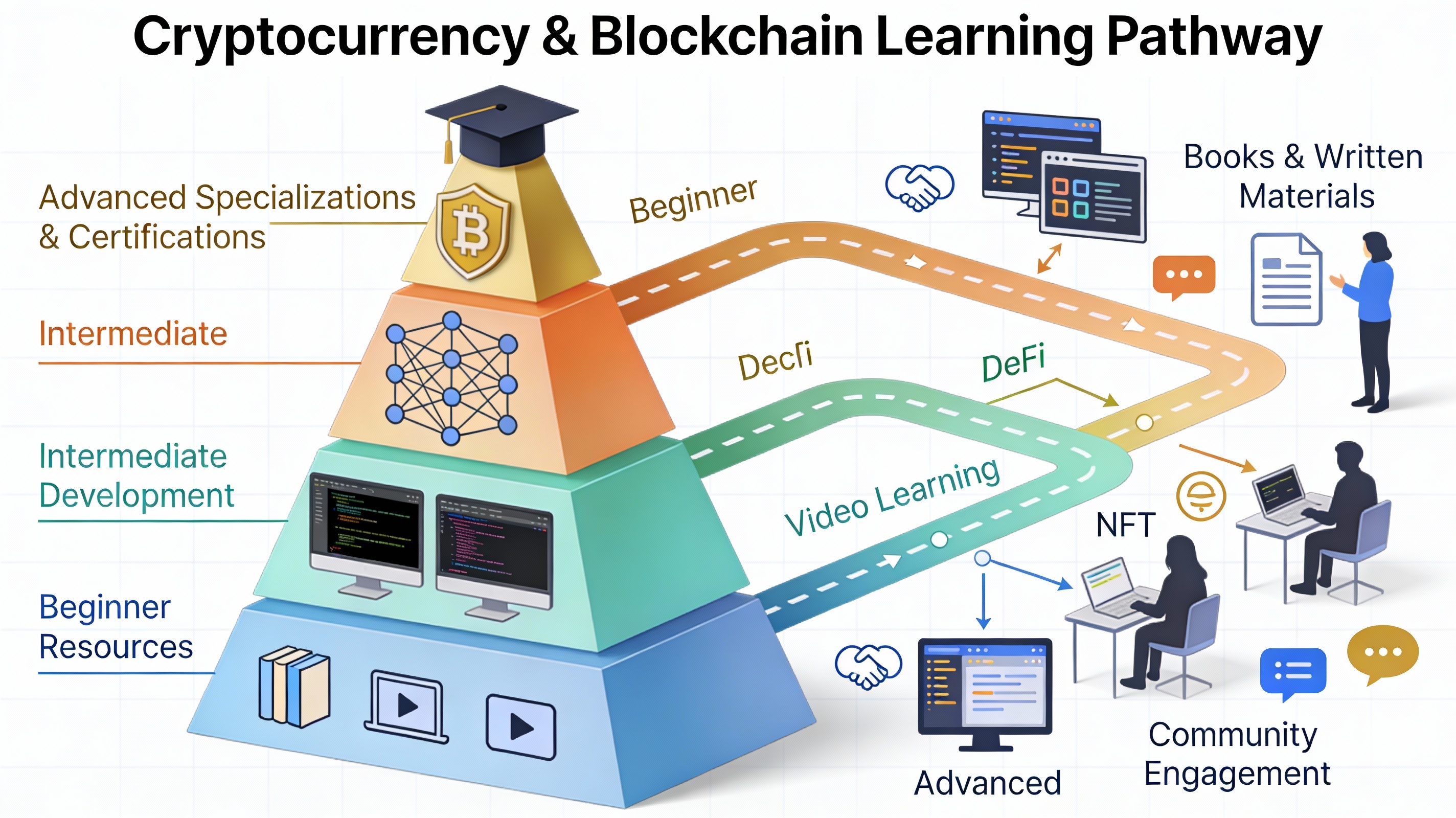

How Can I Learn More About Cryptocurrency and Blockchain Technology?

How Do I Track Cryptocurrency Prices in Real-Time?

Leave a Comment