How Do I Protect Myself from Cryptocurrency Scams? Complete Prevention Guide for 2026

Complete guide to cryptocurrency scam prevention. Discover red flags for phishing attacks, fake wallets, pump-and-dumps, and how to verify legitimate exchanges.

The cryptocurrency market has become a prime target for sophisticated scammers, with nearly $3.1 billion stolen in the first half of 2025 alone—far exceeding annual losses in traditional financial fraud categories. Cryptocurrency's unique characteristics—irreversible transactions, relative anonymity, global reach, and decentralized structure—make it an attractive vehicle for fraud. This comprehensive guide identifies the 12 most common cryptocurrency scams in 2025, outlines red flags for each, and provides actionable protection strategies that can reduce your vulnerability to fraud by 80% or more.

Understanding Why Crypto Scams Are Escalating

Cryptocurrency fraud is accelerating due to several structural factors. First, the prosecution rate for crypto scams remains exceptionally low—fewer than 5% of crypto fraudsters face criminal charges. Second, the reward-to-effort ratio is extraordinarily high; a single successful scam targeting 1,000 people can yield millions with minimal risk. Third, technological advances—particularly AI-powered deepfakes and sophisticated social engineering—have lowered the technical barriers to executing convincing fraud. Finally, the irreversible nature of cryptocurrency transactions means victims have almost no recovery options once funds are transferred.

The 12 Most Common Cryptocurrency Scams in 2025

1. Phishing Attacks: The Dominant Threat

Phishing remains the single most prevalent cryptocurrency scam vector. Scammers create fake emails, text messages (smishing), or social media direct messages that appear to originate from legitimate cryptocurrency exchanges, wallet providers, or DeFi protocols.

How Phishing Works:

You receive an urgent message: "Your wallet has been compromised—click here immediately to secure your account." The link directs you to a pixel-perfect clone of the legitimate website. When you enter your credentials or seed phrase, the scammer captures them instantly. In 2025, the sophistication has escalated dramatically. Scammers now use AI to analyze your transaction history, then send "account security alerts" specifically tailored to your recent activities, dramatically increasing click-through rates.

Red Flags to Recognize:

- Slightly misspelled URLs (e.g., "coinbase-secure.com" instead of "coinbase.com")

- Urgency language: "Act now or lose everything"

- Grammar or spelling errors in official communications

- Requests for private keys or seed phrases (legitimate services never request these)

- Unsolicited messages from "support staff"

- Links that don't match official domains

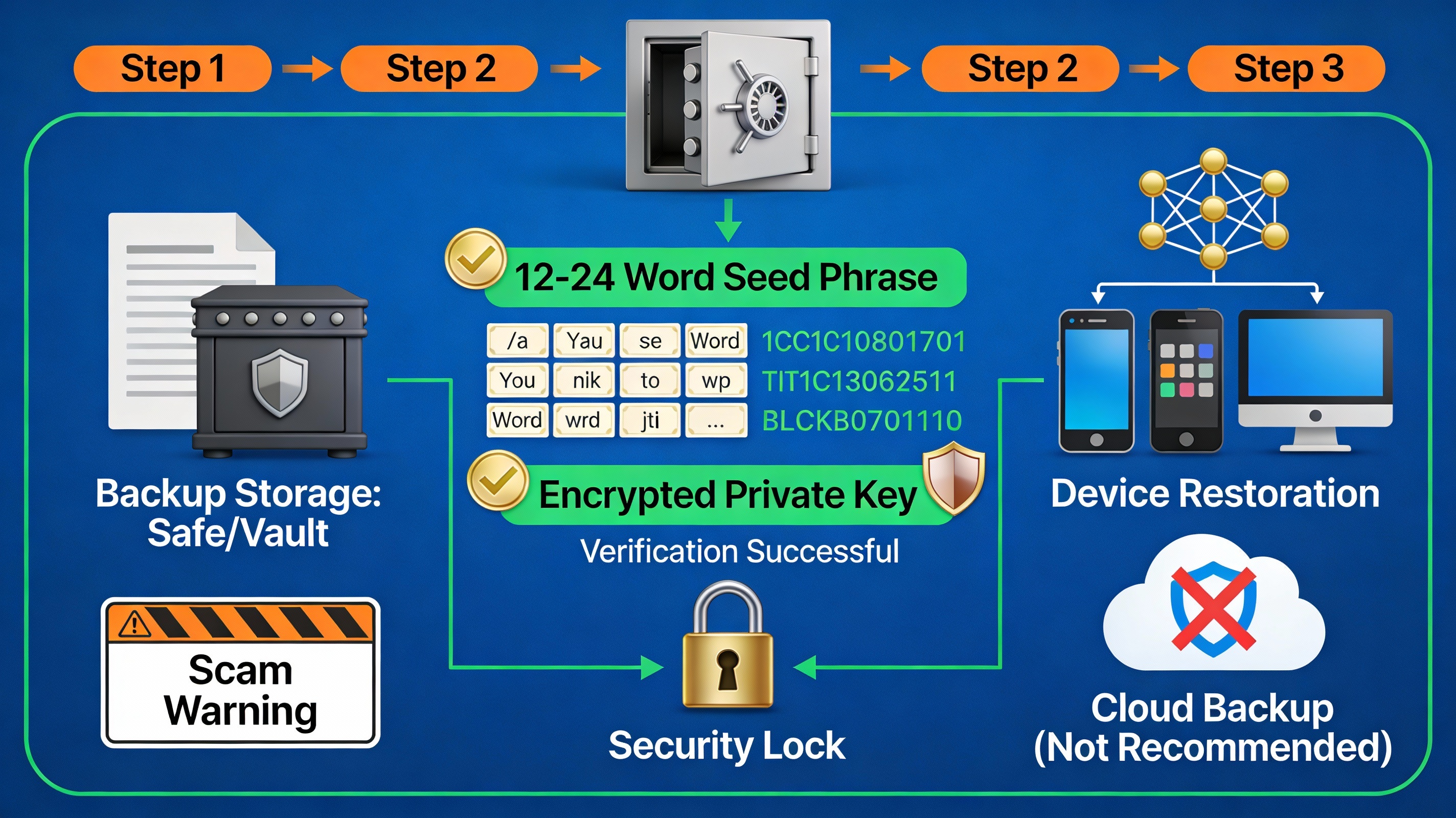

Protection Strategy:

Never click links in unsolicited messages. Always type URLs directly into your browser, or use bookmarks. For wallet connections on DeFi sites, verify the domain and permissions before signing transactions. If you use browser extensions for wallets (MetaMask, etc.), verify they're installed from official sources and regularly check for suspicious permissions.

2. Romance Scams and "Pig Butchering" Schemes

Romance scams—known as "pig butchering" in Asia—are among the highest-value fraud schemes. Scammers create fake identities on dating apps or social media, develop months-long romantic relationships, then gradually introduce cryptocurrency investment opportunities.

How Pig Butchering Works:

A scammer poses as an attractive, successful individual on a dating platform. Over weeks or months, they build emotional connection and trust. Eventually, they mention a "business opportunity" or "investment strategy" that generated exceptional returns for them or a friend. They suggest you start with a small investment. Victims send cryptocurrency to a fake exchange or trading platform controlled by the scammer. Small withdrawals are processed to build confidence. When the victim tries to withdraw their full balance, the platform demands "taxes" or "fees" before releasing funds—or disappears entirely.

Red Flags to Recognize:

- Romantic interest from someone you've never met in person

- Avoidance of video calls or in-person meetings

- Pushing for communication off-platform (WhatsApp, Telegram)

- Introducing cryptocurrency "investment opportunities" suddenly

- Claims of insider access or guaranteed returns

- Pressure to keep the investment secret

- Requests to transfer money to personal wallets (not regulated exchanges)

Protection Strategy:

Never mix romance and financial decisions. Be extremely skeptical of cryptocurrency investment advice from people you've only met online. Verify that any exchange or trading platform is legitimately regulated (check financial regulators' official websites). Never send cryptocurrency directly to individuals; only use established, regulated exchanges.

3. Rug Pulls and Exit Scams

Rug pulls are frauds where developers launch a cryptocurrency token, market it aggressively to attract investor capital, then abandon the project and drain all liquidity.

How Rug Pulls Work:

Developers create a token and deploy it on a decentralized exchange (e.g., Uniswap) with paired liquidity (50% ETH, 50% new token). As investors buy the new token, its price rises. When the liquidity pool reaches substantial value, developers execute the "rug pull": they withdraw all ETH from the liquidity pool, making it impossible for anyone to sell their tokens (no ETH to trade against). The tokens become worthless, and the developers disappear with millions.

Red Flags to Recognize:

- Anonymous team with no verifiable identities

- No smart contract security audit from recognized firms

- Promises of unrealistic returns (30-50%+ annual yield)

- Unlocked liquidity pools (developers can withdraw immediately)

- Rapidly increasing price with suspicious trading patterns

- Poor website design or vague whitepaper

- Celebrity endorsements (particularly deepfaked or paid promotions without disclosure)

- Recent token launch with massive marketing spend

Protection Strategy:

Research thoroughly before investing: (1) Verify team member identities through independent sources, (2) Check for smart contract audits from reputable firms (CertiK, OpenZeppelin), (3) Analyze the liquidity lock duration—legitimate projects lock liquidity for extended periods, (4) Review token distribution—if insiders hold majority supply, risk is high, (5) Check holder concentration on blockchain explorers (Etherscan)—healthy projects have distributed holdings.

4. Fake Cryptocurrency Apps and Wallets

Scammers create counterfeit versions of legitimate wallet apps and exchange apps, distributing them through various channels.

How App Scams Work:

A fake MetaMask or Coinbase app is available on the App Store or Google Play Store (often through publisher name deception or temporarily bypassing security). Victims download the app thinking it's legitimate. The fake app either: (a) requests excessive permissions to access real balances, (b) requests the seed phrase for "account restoration," or (c) functions as a real wallet temporarily, building trust before requesting the seed phrase for a "security update."

Red Flags to Recognize:

- Apps not available on official app stores or third-party distribution

- Templated five-star reviews with minimal comment depth

- Sketchy publisher accounts or non-standard developer names

- Excessive permission requests (e.g., file access, contacts, camera)

- Frequent unsolicited permission prompts

- Broken or inconsistent interface features

- Requests for seed phrase outside of the legitimate restore process

- Apps requesting payment in cryptocurrency only

Protection Strategy:

(1) Download wallet and exchange apps only from official websites linked from verified social profiles, or directly from Apple App Store/Google Play Store, (2) Verify the publisher name carefully—scammers often use similar-sounding names, (3) Read recent reviews carefully for mentions of compromised accounts, (4) Cross-reference app names on official company websites before downloading, (5) Never enter seed phrases into any app except in legitimate wallet restoration (and only when you initiated the process).

5. Deepfake and AI-Powered Social Engineering

Scammers now use AI to create deepfake videos of cryptocurrency celebrities, company executives, or even friends and family members.

How Deepfakes Work:

You receive a video call or message showing someone you trust (a celebrity, exchange CEO, or friend) urging you to send cryptocurrency immediately to a specific wallet "for investment" or "to resolve an urgent issue." The video appears authentic because AI can recreate facial expressions, voice tone, and mannerisms convincingly. You comply, and funds are transferred to the scammer.

Red Flags to Recognize:

- Unusual requests from known contacts (verify through independent communication channels)

- AI artifacts in videos (slightly jerky movements, inconsistent eye contact, audio lag)

- Requests that violate normal communication patterns (e.g., CEO asking for crypto via personal social media)

- Unsolicited offers from anyone claiming insider knowledge

- Claims of limited-time opportunities requiring immediate action

- Requests delivered through unusual channels

Protection Strategy:

(1) Verify through independent channels—if someone claims to be a friend/CEO requesting urgent cryptocurrency transfer, contact them through a known phone number or in-person before complying, (2) Be skeptical of video calls from people you've only met online, (3) Understand that legitimate companies never request cryptocurrency transfers via social media or personal accounts, (4) Enable two-factor authentication on accounts to prevent unauthorized transfers even if your credentials are compromised.

6. Smart Contract Drainers and Approval Exploits

Scammers create fake DeFi applications or NFT mints that request wallet connection and transaction signing. Hidden in the transaction code is an instruction granting the scammer spending approval over your tokens.

How Drainers Work:

You visit what appears to be a legitimate NFT mint or airdrop claiming to distribute free tokens. It requests wallet connection via MetaMask. You approve and sign the transaction. The visible action may appear to be "claiming tokens," but hidden in the transaction is permission granting the scammer's address approval to spend an unlimited amount of your tokens. An automated bot immediately drains your wallet of valuable tokens.

Red Flags to Recognize:

- Random "claim" links from unfamiliar sources

- Requests to connect wallet to unknown protocols

- Transactions requesting "unlimited" or extremely high approval amounts

- Requests outside the stated purpose of the dapp

- Rushed timelines ("limited time offer")

- No clear explanation of what transaction you're signing

Protection Strategy:

(1) Use a "burner wallet" with minimal funds for testing new dapps, (2) Read the human-readable transaction details before signing—understand what approvals you're granting, (3) Regularly review and revoke token approvals using tools like Revoke.cash, (4) Only interact with well-established protocols with audited smart contracts, (5) Never grant unlimited approval unless absolutely necessary, and revoke immediately after transaction completion.

7. Pump-and-Dump and Hype-Based Schemes

Organized groups coordinate to artificially inflate token prices, then sell holdings into uninformed retail investors.

How Pump-and-Dumps Work:

A Telegram or Discord group promotes a "signal" for a specific token scheduled to moon. Large holders accumulate quietly. At the designated time, they announce the signal, triggering coordinated buying. Retail investors, fearing FOMO (fear of missing out), buy aggressively, driving price higher. Large holders then sell into the buying pressure, crashing the price. Retail investors are left holding worthless or severely depreciated tokens.

Red Flags to Recognize:

- Trading groups promising "inside signals" or "moon predictions"

- Unverified partnerships or celebrity endorsements

- Tokens with only "price go up" narrative and no utility

- Suspicious holder distribution (few addresses control majority supply)

- Sudden price spikes with no fundamental reason

- Persistent social media promotion from multiple accounts

- Premium subscription required to access "signals"

Protection Strategy:

(1) Read independent sources and verify claims on block explorers (Etherscan), (2) Check liquidity depth—can you actually sell your position without massive slippage?, (3) Analyze token holder distribution—if insiders control 50%+ of supply, risk is extreme, (4) Never invest based on social media hype alone, (5) Diversify holdings across multiple tokens and avoid concentration in newly launched projects.

8. Romance + Investment Hybrid Scams

A more sophisticated evolution combines romantic connection with fake investment platform access.

How Hybrid Scams Work:

A romantic interest develops over weeks. Eventually, they claim to be a "crypto trader" with exceptional returns. They offer to help you invest through a "private platform" accessible only to their network. Initial small investments show impressive returns (actually fabricated account statements). As you increase investment size, returns disappear. When you try to withdraw, the platform demands taxes or fees. The entire platform and relationship vanish.

Red Flags to Recognize:

- Romantic interest promoting investment opportunities

- Private platforms not available through regulated channels

- Fabricated returns or account statements

- Demands for additional funds to access "premium" features

- Inability to withdraw funds without payment

- Platform has no regulatory oversight or registration

Protection Strategy:

Follow the principle: "never mix romance and ROI." Verify any investment platform through financial regulators. Only use established, regulated exchanges. Never invest based on advice from online relationships.

9. Fake Crypto Support and Customer Service Scams

Scammers impersonate customer support for exchanges and wallets, targeting users experiencing genuine issues.

How Support Scams Work:

You're having trouble accessing your exchange account. A "support agent" DMs you on Discord or Twitter (actually a scammer) offering to help. They request your email and password to "check your account." Once provided, they access your account and drain it. Or they request your seed phrase for "account recovery."

Red Flags to Recognize:

- Unsolicited DMs from "support staff"

- Legitimate companies never ask for passwords or seed phrases

- Links to external sites claiming to be support portals

- Requests for personal information via social media (not official support channels)

- Grammar or spelling errors in "official" communications

- Urgency language ("act now or lose access")

Protection Strategy:

(1) Contact support only through official website contact forms or verified social media accounts, (2) Never share passwords or seed phrases with anyone, regardless of identity, (3) Use multi-factor authentication to prevent account takeover even if credentials are compromised, (4) When in doubt, contact the company's official customer service number independently.

10. Recruitment and Job Scams in Crypto

Scammers pose as recruiters for blockchain companies, offering "easy" crypto job opportunities.

How Recruitment Scams Work:

You see a job posting for a remote crypto company position. "Recruiters" contact you via WhatsApp or Telegram. They skip normal HR processes and request you to use your personal crypto wallet for "test transfers" or "security checks." Or they ask for VPN credentials or SSO access to "verify" your technical skills. Once granted, scammers access company or personal infrastructure.

Red Flags to Recognize:

- Interviews conducted only over messaging apps (no video interviews)

- Requests to use personal wallets for "test tasks"

- Skipping normal HR processes and background checks

- Requests for VPN credentials or system access during interview

- Job offers without formal background verification

- "Test" tasks involving crypto transfers or approvals

Protection Strategy:

Research companies thoroughly—verify job postings on official company websites. Never provide credentials or wallet access during interviews. Use dedicated business accounts separate from personal accounts. Request video interviews for legitimacy verification.

11. Address Poisoning

Scammers send small amounts of cryptocurrency to your wallet from addresses resembling legitimate protocol addresses.

How Address Poisoning Works:

You've been sending tokens to Uniswap's contract address regularly. A scammer sends you one token from an address that looks nearly identical (e.g., "0x1111...1111" instead of "0x1111...1110"). When you copy this token's address from your transaction history instead of verifying it independently, you actually send funds to the scammer's address. By the time you notice the discrepancy, funds are gone.

Red Flags to Recognize:

- Unfamiliar tokens appearing in your wallet

- Addresses in transaction history that look similar to trusted addresses

- Copy-pasting addresses without verification

Protection Strategy:

(1) Create a contact list or address book of frequently used recipient addresses, (2) Use domain name services (Ethereum Name Service) to simplify address management, (3) Never copy addresses from transaction history without verification, (4) Double-check the first and last 4 characters of addresses before sending funds, (5) For large transfers, send a test amount first.

12. Fake Exchanges and Trading Platforms

Scammers create fake exchanges that appear legitimate but are actually designed to steal funds.

How Fake Exchanges Work:

You discover a crypto exchange with exceptional trading features and zero fees. After creating an account and depositing funds, the platform functions normally temporarily. When you try to withdraw, the platform claims technical issues or demands additional "verification" fees. Communication becomes impossible, and the platform eventually disappears.

Red Flags to Recognize:

- Unregistered platforms (check regulatory databases)

- No verifiable company information or legal registration

- Extremely low fees compared to legitimate competitors

- Difficulty with withdrawal processes

- Pressure to deposit more funds for "premium" features

- No responsive customer support

Protection Strategy:

Only use exchanges registered with financial regulators in your jurisdiction. Verify regulatory status on official regulator websites (SEC, FCA, etc.). Check independent reviews and community feedback. Start with small deposits to test withdrawal processes before transferring significant amounts.

The $3.1 Billion Reality: 2025 Scam Statistics

To understand the scale of the problem: The first half of 2025 saw nearly $3.1 billion in cryptocurrency fraud losses. Notable incidents included a $45 million social engineering attack on Coinbase where insiders were bribed to leak customer data. The DOJ's October 2025 operation recovered $15 billion from global romance scam networks—demonstrating both the massive scale of fraud and growing law enforcement capabilities.

Comprehensive Protection Strategy: A Layered Approach

No single protection method guarantees immunity from scams. Instead, use layered security:

Layer 1: Behavioral Protections

- Trust your instincts: If an opportunity sounds too good to be true, it is

- Research thoroughly: Spend time verifying claims before committing funds

- Limit FOMO decisions: Never invest based purely on urgency or hype

- Diversify holdings: Avoid concentration in single tokens or platforms

- Small test transfers: Send test amounts before large transfers

Layer 2: Technical Protections

- Use hardware wallets: For holdings exceeding trading amounts

- Enable 2FA: Use authenticator apps, not SMS

- Use strong passwords: Unique, complex passwords for each platform

- Verify URLs: Always check domain names carefully

- Use VPN: For cryptocurrency transactions on untrusted networks

- Browser security: Install reputable antivirus and anti-malware software

Layer 3: Verification Protocols

- Independent contact: Verify urgent requests through known contact channels

- Smart contract audits: Check for reputable audits before interacting with new protocols

- Regulatory verification: Confirm platforms are registered with relevant authorities

- Community feedback: Research on independent forums and Discord servers

- Domain verification: Use ENS or similar services for address security

Layer 4: Post-Incident Response

- Immediate action: If compromised, immediately revoke token approvals using Revoke.cash

- Contact authorities: Report to local law enforcement and financial regulators

- Alert platforms: Notify exchanges and wallet providers immediately

- Blockchain analysis: Track stolen funds through blockchain explorers

- Recovery tools: Use specialized recovery services if applicable

Jurisdiction-Specific Considerations (India Focus)

For Indian cryptocurrency investors, additional considerations apply:

- RBI restrictions: Understand that banks may restrict crypto transactions; use regulated platforms

- Tax compliance: All crypto transactions are taxable; maintain detailed records

- PMLA reporting: Suspicious activity must be reported under Prevention of Money Laundering Act

- SEBI jurisdiction: Certain crypto investments may fall under securities regulations

- Regional scams: Be aware of local Telegram and WhatsApp group scams targeting Indian investors

- Rupee ramp-on: Use established INR-crypto gateways (Kraken India, Giottus, etc.) rather than P2P exchanges with unknown counterparties

What to Do If You've Been Scammed

If you've already lost funds to a cryptocurrency scam, take immediate action during the "golden hour":

- Document everything: Screenshot all communications, transaction hashes, wallet addresses

- Revoke approvals: Use Revoke.cash to revoke token approvals immediately

- Report to authorities: File reports with local police, FBI (IC3.gov), and FTC (reportfraud.ftc.gov)

- Contact platforms: Alert your exchange and wallet provider

- Trace funds: Use blockchain explorers to track where your funds were transferred

- Monitor recovery: Law enforcement and blockchain analysis firms may be able to recover funds

- Check for additional compromise: Verify all other accounts for unauthorized access

- Recovery services: Some specialized firms offer recovery assistance (evaluate carefully for legitimacy)

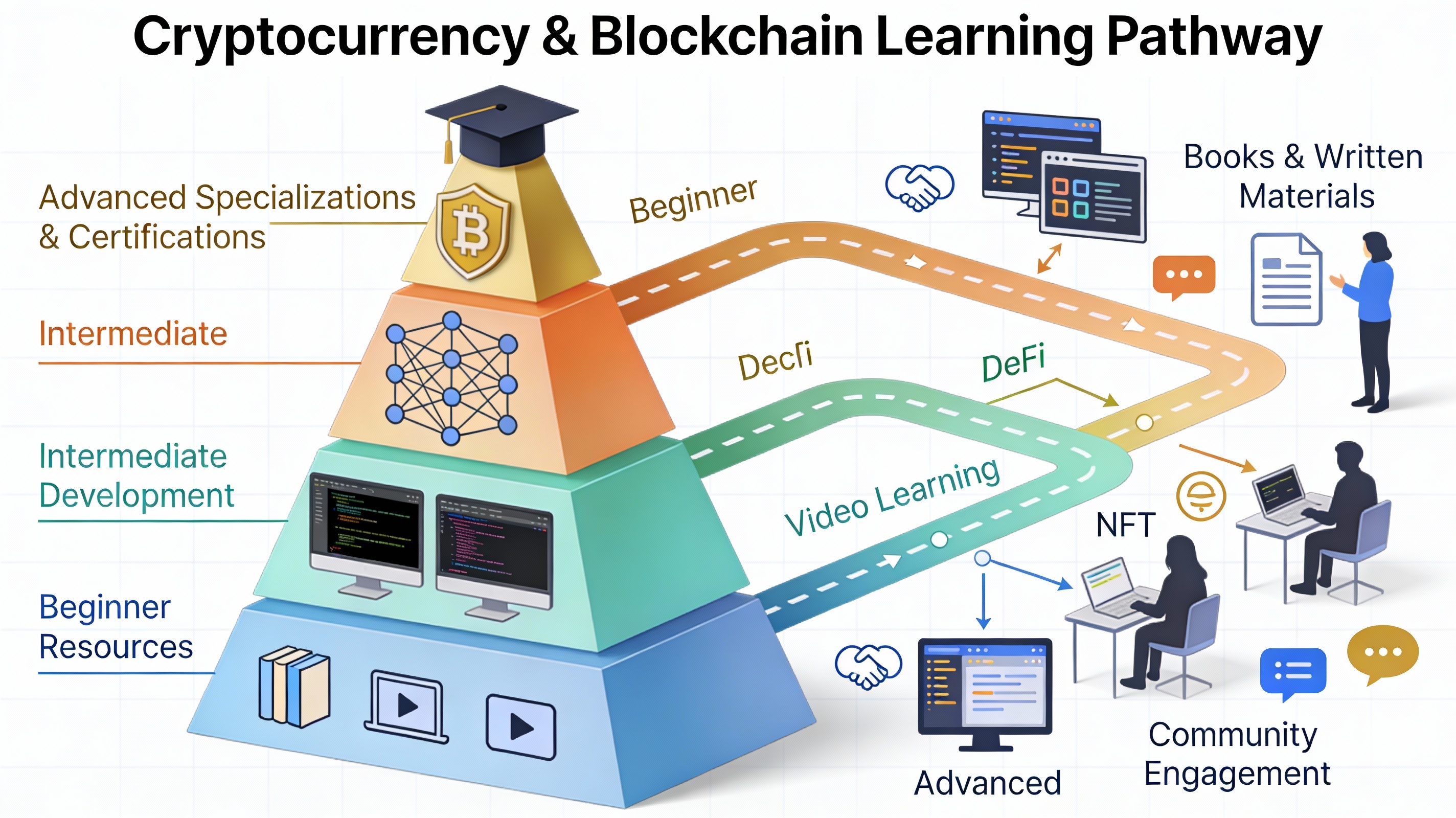

Eternal Vigilance

Protecting yourself from cryptocurrency scams requires ongoing education, healthy skepticism, and disciplined security practices. The scammers are constantly evolving their tactics—AI deepfakes, social engineering exploits, and technical innovations emerge monthly. Your best defense is understanding how these scams work, recognizing red flags early, and maintaining multiple layers of security.

The fundamental principle remains: Cryptocurrency transactions are irreversible. Once transferred, funds are usually unrecoverable. This irreversibility makes prevention dramatically more important than remediation. Invest the time to understand the scams, implement the protections outlined in this guide, and be skeptical of any opportunity that promises quick, guaranteed returns with minimal risk.

Comments 0

Most Read

What Is the Concept of Tokenization in Blockchain?

Bitcoin & Ethereum Market Momentum Update

Recommended Post

What Is the Concept of Tokenization in Blockchain?

How Do I Avoid Common Mistakes When Trading Cryptocurrencies?

How Do I Recover a Lost Cryptocurrency Wallet?

How Can I Learn More About Cryptocurrency and Blockchain Technology?

How Do I Track Cryptocurrency Prices in Real-Time?

Leave a Comment