Fed's Fractured 2026 Vision: What It Spells for Bitcoin, Ethereum, and the Crypto Landscape

Explore how the Federal Reserve's uncertain 2026 interest rate projections could impact Bitcoin and Ethereum. Dive into market analysis, expert insights, and key ETH metrics amid economic shifts.

The United States Federal Reserve's recent projections for 2026 reveal significant divisions among policymakers, injecting uncertainty into financial markets, including cryptocurrencies. Despite three rate cuts in 2025, interest rates remain at multi-decade highs, and the Fed's cautious approach could either support or constrain the growth of assets like Bitcoin (BTC) and Ethereum (ETH). This article examines the Fed's outlook, its potential implications for the crypto sector, market analysis, expert opinions, and key Ethereum metrics.

Federal Reserve's 2026 Projections: A House Divided

The Fed's December 2025 dot plot shows policymakers evenly split, with equal support for zero, one, or two rate cuts in 2026. This divergence reflects differing views on inflation (potentially influenced by tariffs), labor market conditions, and economic growth. The median forecast expects rates to end 2025 at 3.6% and ease modestly to 3.4% by the end of 2026, suggesting only one cut for the year.

Current rates are between 3.5% and 3.75% following the December 10, 2025, reduction—an 18-year high. The January 27-28 meeting will provide the next update, with CME Group tools showing just a 20% probability of a January cut, increasing to 45% by March.

Further complexity arises from the leadership transition: Jerome Powell's term as Chair expires in May 202, and President Donald Trump is considering more dovish replacements, potentially shifting toward easier policy.

Impact on Bitcoin and the Broader Crypto Market

Monetary policy has long influenced crypto performance. Lower rates typically drive investors toward risk assets by reducing yields on safer alternatives, increasing liquidity and demand for cryptocurrencies.

In a baseline scenario, one early-2026 cut combined with continued Treasury bill purchases could support steady crypto inflows. A more optimistic path—two cuts amid cooling inflation and softening employment—might spark significant risk-on enthusiasm. However, persistent inflation could delay easing, leading to sharp market corrections.

Market Analysis: Navigating Uncertainty

The Fed's indecision heightens volatility for digital assets. Sustained high rates may suppress risk appetite and limit inflows, while potential easing could accelerate adoption. Factors like geopolitical tensions, tariff policies, and dollar strength add layers of complexity—a weaker USD might bolster crypto's hedge appeal, particularly for Bitcoin as "digital gold." Ethereum, central to DeFi and NFTs, could benefit disproportionately from increased liquidity, encouraging borrowing and staking.

Expert Opinions: Voices from the Field

Industry experts offer varied perspectives on the Fed's signals:

- Jeff Ko, Chief Analyst at CoinEx Research, anticipates two 2026 cuts: possibly one in March under Powell, with further easing after the leadership change, supporting crypto if labor weakens and inflation temporarily rises.

- Jeff Mei, COO at BTSE, outlines scenarios: a base case of one Q1 cut aiding liquidity; a bull case of two cuts driving strong demand; and a bear case of stalled progress due to inflation, causing downturns.

- Justin d'Anethan, Head of Research at Arctic Digital, notes the cautious tone is tempering crypto optimism, as investors position for fiat depreciation and liquidity changes.

Key Ethereum Metrics: A Closer Look

As of December 31, 2025, Ethereum maintains a strong market position:

- Current Price: Approximately $3,350 USD

- Market Capitalization: Over $400 billion

- 24-Hour Trading Volume: Around $20-25 billion USD

- Recent Performance: Consolidating after 2025 gains, reflecting broader market caution

- All-Time High: $4,891 USD (November 2021)

Ethereum's role in smart contracts, DeFi, and layer-2 scaling solutions positions it for potential upside if rate cuts materialize and ecosystem activity rebounds.

The Federal Reserve's divided 2026 projections create a pivotal moment for cryptocurrencies. While near-term caution prevails due to elevated rates, the prospect of gradual easing—possibly accelerated by leadership changes—offers a pathway for renewed bullish momentum in Bitcoin and Ethereum. Market participants should closely watch upcoming economic indicators and FOMC communications, as they will likely dictate the direction for risk assets in the coming year.

Source & Image - https://cointelegraph.com/news/fed-divided-2026-outlook-means-bitcoin-and-crypto

Comments 0

Most Read

What Is the Concept of Tokenization in Blockchain?

Bitcoin & Ethereum Market Momentum Update

Recommended Post

What Is the Concept of Tokenization in Blockchain?

How Do I Avoid Common Mistakes When Trading Cryptocurrencies?

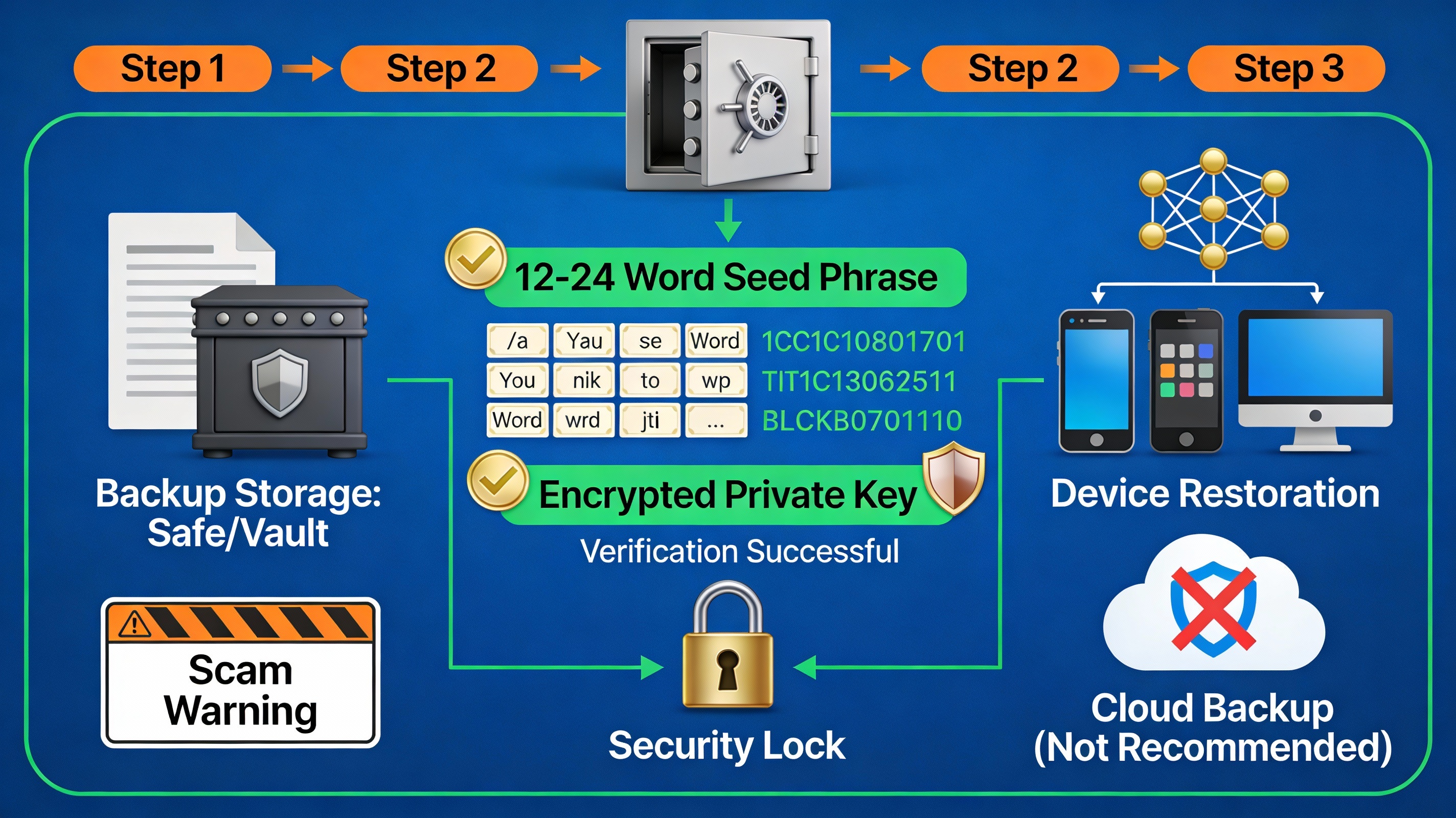

How Do I Recover a Lost Cryptocurrency Wallet?

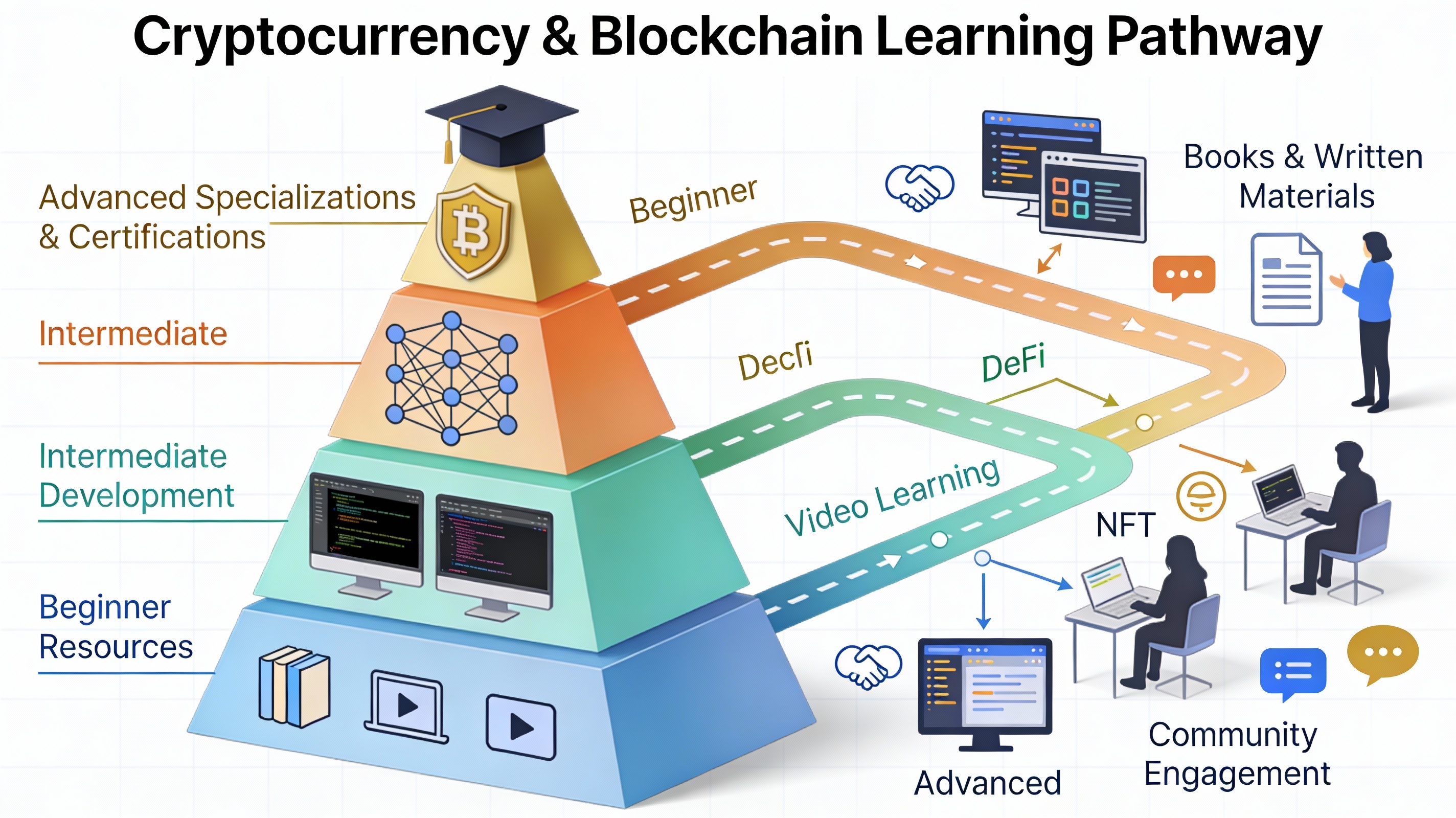

How Can I Learn More About Cryptocurrency and Blockchain Technology?

How Do I Track Cryptocurrency Prices in Real-Time?

Leave a Comment