What Is the Concept of Tokenization in Blockchain?

What is blockchain tokenization? Learn how real-world assets convert to digital tokens. Explore RWA markets, platforms, investment opportunities, and 2026 growth.

Tokenization represents one of blockchain's most transformative applications: the conversion of physical, financial, and intangible assets into blockchain-based digital tokens representing ownership rights. This process bridges traditional finance and cryptocurrency, enabling fractional ownership, 24/7 global trading, near-instant settlement, and dramatically reduced intermediaries. The real-world asset (RWA) tokenization market grew 308% between 2022-2025, reaching $24 billion, with projections suggesting $2-30 trillion market value by 2030. This comprehensive guide explains tokenization mechanics, asset classes, benefits, technical implementation, regulatory landscape, and investment opportunities across real estate, securities, commodities, carbon credits, and emerging applications. For blockchain practitioners, financial institutions, and investors, tokenization represents the infrastructure bridge converting traditional finance's $500+ trillion in assets into programmable, liquid blockchain-native instruments.

Understanding Tokenization: Core Concept

Definition: Tokenization is the process of converting ownership rights in real-world or financial assets into blockchain-based digital tokens, where each token represents a verifiable and transferable unit of value.

Simple Example:

A $1 million commercial real estate property is tokenized into 100,000 tokens. Each token = $10 ownership stake. Previously, buying property required $1,000,000 minimum investment and months of legal paperwork. Now, investors purchase tokens for any amount ($100, $10,000), execute transactions in minutes, trade 24/7, and achieve instant settlement.

Key Principle: Tokenization doesn't change asset ownership fundamentally—it changes how ownership is documented, transferred, and traded. Instead of paper deeds and centralized registries, ownership is cryptographically recorded on distributed ledgers accessible globally.

Two Critical Components:

- Off-chain asset: Physical property, government bond, or commodity exists in real world

- On-chain representation: Blockchain token represents ownership claim to that asset

This dual structure is essential—blockchain token has zero value without corresponding real-world asset and custody/verification mechanisms.

How Tokenization Works: Step-by-Step Process

Step 1: Asset Identification and Structuring

Suitable Assets for Tokenization:

- Real estate (commercial, residential, commercial property portfolios)

- Financial securities (stocks, bonds, government treasuries)

- Commodities (gold, oil, agricultural products)

- Alternative assets (art, collectibles, intellectual property)

- Receivables and invoices (supply chain financing)

- Carbon credits and environmental credits

- Insurance and structured products

- Private credit and loan portfolios

Asset Structuring Requirements:

- Establish clear ownership structure (special-purpose vehicle or trust)

- Determine asset custody (who holds physical/legal asset)

- Define valuation methodology (how token value is determined)

- Identify regulatory jurisdiction (which laws apply)

- Set token-to-asset ratio (how many tokens per asset unit)

Step 2: Smart Contract Development

Smart Contracts Define:

- Token supply (total number of tokens issuable)

- Transfer restrictions (who can trade tokens, when, under what conditions)

- Dividend/yield mechanisms (how returns distributed to token holders)

- Compliance rules (KYC requirements, accredited investor verification, geographic restrictions)

- Lifecycle management (minting, burning, pause functionality)

Token Standards Used:

- ERC-20 (Ethereum): Fungible tokens (interchangeable), simple implementation

- ERC-1400 (Ethereum): Security tokens with built-in compliance

- ERC-3643 (Ethereum): Advanced compliance features (transfer restrictions, investor verification)

- SPL tokens (Solana): High-speed, low-cost tokenization

- TRC-20 (TRON): Alternative blockchain implementation

Step 3: Asset Custody and Verification

Custody: Third-party regulated custodian holds underlying asset in secure facility

- Real estate: Licensed real estate custodian holds legal deed

- Precious metals: Vault storage with insurance

- Securities: Registered broker-dealer custody

- Cash: Bank deposit in trust account

Verification: Independent auditor confirms:

- Asset exists and matches description

- Custodian legitimately holds asset

- No liens or encumbrances

- Asset meets stated valuation

Proof of Reserves: Chainlink and similar oracle networks verify custodian claims through on-chain data feeds, confirming asset backing without revealing proprietary details.

Step 4: Token Issuance and Distribution

Minting Process:

- Smart contract creates fixed number of tokens

- Tokens issued on chosen blockchain

- Initial distribution to investors via:

- Private placement (accredited investors only)

- Public offering (if regulatory compliant)

- Whitelisted trading venues (regulated platforms)

Investor Access Mechanisms:

- Direct purchase via token issuer's platform

- Secondary market trading (after initial issuance)

- DeFi protocols (lending, yield farming with tokenized assets)

Step 5: Ongoing Management and Trading

Automated Operations via Smart Contracts:

- Dividend Distribution: Yield from underlying asset automatically distributed to token holders proportional to holdings

- Interest Payments: Bond coupon payments automatically processed

- Rebalancing: Portfolio adjustments executed without manual intervention

- Settlements: Token transfers settled near-instantly (seconds) versus traditional T+2 settlement

Secondary Markets:

- Tokens trade on regulated exchanges (Coinbase, Kraken) or tokenization-specific platforms (Ondo Finance, Centrifuge, RealT)

- Price discovery through continuous trading

- Liquidity provided by market makers

- 24/7 trading across global markets

Asset Classes Being Tokenized (2025)

Real-World Assets Market Leadership: Real Estate

Tokenized Real Estate Platforms:

- RealT, Brickken: Fractional residential property ownership

- Dubai Land Department: Tokenizing $16 billion real estate by 2033

- Centrifuge: Tokenized property-backed loans

- Harbor: Institutional real estate tokenization

Benefits:

- Fractional ownership: Buy $500 stake in $5M building

- Global investor access: Trade property 24/7

- Reduced friction: Months of paperwork → minutes of transaction

- Liquidity unlock: Previously illiquid asset becomes tradable

Market Size: Real estate represents 20-30% of emerging RWA tokenization focus

Government Securities and Bonds

Tokenized Treasuries Leadership:

- Franklin Templeton: Tokenized money market fund ($360M TVL, 2025)

- Ondo Finance: US Treasury tokenization via OUSG

- MakerDAO: Tokenized government bonds as collateral

- JPMorgan: Tokenized money market funds for institutional clients

Mechanics:

- Entity purchases US Treasury bills

- Issues tokens representing fractional ownership of Treasury pool

- Token value tracks Treasury value (typically $1.00)

- Yield automatically distributed to token holders (4-5% annually)

Advantages Over Traditional:

- Buy Treasury stake for any amount ($100 vs $10,000 minimum)

- Trade 24/7 (vs single business day settlement)

- No intermediaries (direct treasury access)

- Transparent, on-chain yield tracking

2025 Data: $40.41 billion in crypto RWAs, heavily weighted toward tokenized treasuries

Commodities (Gold, Metals, Energy)

Tokenized Commodities:

- Paxos Gold (PAXG): 1 token = 1 oz fine gold, fully audited reserves

- Tether Gold (XAUT): Similar gold tokenization

- Crude Oil futures: Tokenized energy contracts

- Agricultural products: Soybean, wheat, cocoa tokenization

Unique Benefits:

- Fractional ownership: Buy $100 worth of gold instantly

- Transparent reserves: Chainlink proofs verify gold holdings weekly

- Trading efficiency: Instant settlement vs days in traditional markets

- Geographic access: Purchase global commodities from anywhere

Private Credit and Invoices

On-Chain Private Credit:

- Maple Finance, Goldfinch: Institutional-grade loan tokenization

- Centrifuge: Trade finance and invoice factoring

- TradFi Lenders: Syndicated loans tokenized for faster capital mobilization

Yield Profiles: 8-15% returns from tokenized lending pools, transparent risk metrics

Carbon Credits and Environmental Assets

Tokenized Carbon Markets:

- Verra, Gold Standard: Verified carbon credit tokenization

- Toucan, Moss: Carbon credit marketplaces enabling fractional ownership

- ESG Investing: Environmental credit portfolios tracking compliance

Growth Driver: Corporate ESG commitments requiring transparent, tradable carbon offset tracking

Key Benefits of Tokenization

1. Enhanced Liquidity

Traditional Real Estate Purchase Flow:

- Identify property (weeks)

- Negotiate terms (weeks)

- Legal review (days)

- Financing arrangement (weeks)

- Closing and settlement (days)

- Total: 2-4 months minimum

Tokenized Real Estate Purchase Flow:

- Browse tokenized properties (minutes)

- Purchase fractional stake (minutes)

- Settlement (seconds)

- Total: 10 minutes

Liquidity Economics: Ability to exit position immediately (vs property stuck for 2-4 months) unlocks capital for investors, increases total addressable market by 5-10x

2. Fractional Ownership and Democratization

Before Tokenization:

- $10 million commercial property = only wealthy investors could afford

- Minimum investment: $500,000-$1,000,000

- Investor base: ~100-200 accredited investors maximum

After Tokenization:

- $10 million property = 100,000 tokens × $100 price

- Minimum investment: $100

- Investor base: millions of global investors

- Community ownership models enabled

Impact: Historically exclusive asset classes (art, real estate, private equity) become accessible to average retail investor

3. Operational Efficiency and Cost Reduction

Manual Processes Eliminated:

- Physical deed transfers → blockchain settlement (seconds vs weeks)

- Manual dividend distribution → smart contract automation

- Custodial delays → instant final settlement

- Intermediary markup → disintermediation (brokers, custodians, clearinghouses)

Cost Savings:

- Traditional corporate bond issuance: 2-5% of issuance amount

- Tokenized bond issuance: 0.1-0.5% of issuance amount

- Trading fees: 0.01-0.1% (vs 0.25-0.50% traditional)

Settlement Cost: Reducing T+2 settlement to near-instant saves $200+ billion globally in capital tied up in settlement cycles

4. Transparency and Auditability

On-Chain Transparency:

- Every token transfer recorded immutably with timestamp

- Full ownership history visible to all participants

- Dividend distribution tracked in real-time

- Fraud nearly impossible (cryptographic verification)

Audit Trail: Auditors and regulators access complete transaction history in minutes (vs requesting records from multiple intermediaries)

Fraud Reduction: Counterfeit assets, misrepresentation, and ownership disputes eliminated through immutable ledger

5. 24/7 Global Trading and Accessibility

Traditional Markets:

- Limited trading hours (9:30 AM - 4:00 PM business days)

- Geographic restrictions (trading only in home country exchanges)

- Currency restrictions (need local bank account)

- Holiday closures

Tokenized Markets:

- 24/7 continuous trading

- Global participation (any investor, any country)

- Multi-currency settlement

- No holiday closures

Opportunity: Real estate property in Singapore trades globally from Singapore to New York to Tokyo during overlapping hours—impossible in traditional markets

6. Programmability and Automation

Smart Contract Capabilities:

- Automatic coupon/dividend payments calculated and distributed without manual intervention

- Yield optimization: Tokens supplied to DeFi protocols earning additional yield

- Escrow automation: Tokenized collateral automatically released upon contract completion

- Atomic settlement: Payment and asset transfer occur simultaneously (eliminate counterparty risk)

Tokenization Use Cases and Platforms (2025)

Real Estate

- Platforms: RealT, Brickken, Harbour, Propy

- Assets: Residential, commercial, mixed-use properties

- Returns: 8-12% annual yield plus appreciation potential

Government Bonds and Treasuries

- Platforms: Ondo Finance (OUSG), Maple Finance, MakerDAO

- Assets: US T-Bills, government bonds

- Returns: 4.5-5.5% stablecoin yield

Private Credit

- Platforms: Maple Finance, Goldfinch, Centrifuge

- Assets: Syndicated loans, invoice financing

- Returns: 8-15% depending on credit quality

Commodities

- Platforms: Paxos Gold, Tether Gold, Arca, Vanguard

- Assets: Gold, metals, energy futures

- Returns: Spot price appreciation plus storage savings

Carbon Credits

- Platforms: Toucan, Verra, Gold Standard

- Assets: Verified emissions reductions, nature credits

- Returns: Corporate demand-driven value appreciation

Securities and Equities

- Platforms: Backed Finance, Securitize, Polymath

- Assets: Stocks, ETFs, mutual funds

- Returns: Dividend yields plus capital appreciation

Technical Implementation and Blockchain Selection

Ethereum

- Advantages: Most mature ecosystem, ERC-1400/3643 standards, $500B+ TVL

- Limitations: Higher fees during congestion, Layer 2 solutions required for scale

- Use Case: Complex institutional tokenization, compliance-heavy securities

Solana

- Advantages: 50,000+ TPS, $0.00001 transaction costs, SPL standard

- Limitations: Network downtime history, smaller institutional adoption

- Use Case: High-volume retail tokenization, commodities

Polygon (Ethereum Layer 2)

- Advantages: EVM compatibility, 7,000+ TPS, <$0.01 fees

- Limitations: Depends on Ethereum for security

- Use Case: Mid-market tokenization, cost-sensitive applications

TRON

- Advantages: Chinese market adoption, TRC-20 standard, billions in volume

- Limitations: Regulatory uncertainty in Western markets

- Use Case: Asia-focused real estate and securities tokenization

Regulatory Landscape and Compliance (2025)

United States

- SEC Oversight: Securities tokens (representing equity/debt) classified as securities

- Compliance Requirements: Registration (Form S-1), ongoing reporting, accredited investor verification

- FINRA Rules: Transfer restrictions, custody requirements, AML/KYC

- State Laws: Money transmitter licenses required in some jurisdictions

European Union

- MiCA Regulation: Markets in Crypto-Assets Regulation provides clear tokenization framework

- Crypto Service Provider License: Required for custodians and trading platforms

- Advantages: Clear path to compliance driving institutional adoption

India

- RBI Position: Acknowledges tokenization benefits; actively researching frameworks

- Focus Areas: Tokenized deposits, cross-border payments, cash collateral management

- Status: 2025-2026 expected to see pilot programs and regulatory guidance

UAE/Dubai

- Leadership: Dubai Land Department tokenizing $16 billion real estate

- Regulatory Support: Clear frameworks attracting global institutions

Challenges and Limitations

Regulatory Uncertainty

- Different jurisdictions apply conflicting rules

- Compliance costs high ($500K-$5M initially)

- Status of tokenized assets evolving (some countries ban crypto altogether)

Solution: Regulatory arbitrage—jurisdictions with clear frameworks attracting institutional capital (Dubai, Singapore, EU)

Custody and Asset Verification

- Third-party custodian adds counterparty risk

- Physical asset verification expensive

- Proof-of-reserves oracles create data dependencies

Solutions: Regulated custodians with insurance, independent audits, multiple custody providers

Technical Risks

- Smart contract bugs can cause fund loss

- Blockchain forking risks

- Integration with traditional settlement systems (T+2) creates friction

Solutions: Formal verification of contracts, audits by specialized firms, Layer 2 solutions for cost/speed

Market Liquidity

- Many tokenized assets illiquid (few buyers/sellers)

- Bid-ask spreads wide (2-5% vs 0.1% traditional markets)

- Immature secondary markets

Solutions: Aggregation platforms, market maker incentives, institutional participation

Market Size and Growth Projections

Current Market (2025)

- RWA tokenization: $24-40 billion total market

- Tokenized treasuries: $40+ billion

- Institutional adoption: JPMorgan, Franklin Templeton, major custodians

- Deal volume: 5-10 major institutional tokenization projects monthly

2030 Projections

- Conservative (McKinsey): $2 trillion RWA tokenization market

- Aggressive (Standard Chartered): $30 trillion RWA tokenization market

- Base Case (Gartner): $5-15 trillion market

Growth Drivers

- Regulatory clarity in major jurisdictions

- Institutional adoption (pensions, insurance, endowments)

- DeFi maturation enabling yield optimization

- Emerging market inclusion (banking unbanked populations)

Tokenization as Infrastructure Revolution

Tokenization represents fundamental financial infrastructure modernization. Converting static paper-based systems into programmable, liquid, transparent blockchain-native instruments unlocks trillions in capital efficiency, expands investor access to $500+ trillion in existing assets, and enables completely new financial structures impossible in traditional markets.

The technology is proven. Institutional adoption is accelerating. Regulatory frameworks are crystallizing. The remaining questions aren't "if" but "how quickly" tokenization becomes dominant infrastructure for asset ownership and trading globally.

For investors, entrepreneurs, and institutions, tokenization represents the frontier where blockchain technology meets traditional finance—with the potential to reshape capital markets fundamentally.

Comments 0

Most Read

What Is the Concept of Tokenization in Blockchain?

Bitcoin & Ethereum Market Momentum Update

Recommended Post

What Is the Concept of Tokenization in Blockchain?

How Do I Avoid Common Mistakes When Trading Cryptocurrencies?

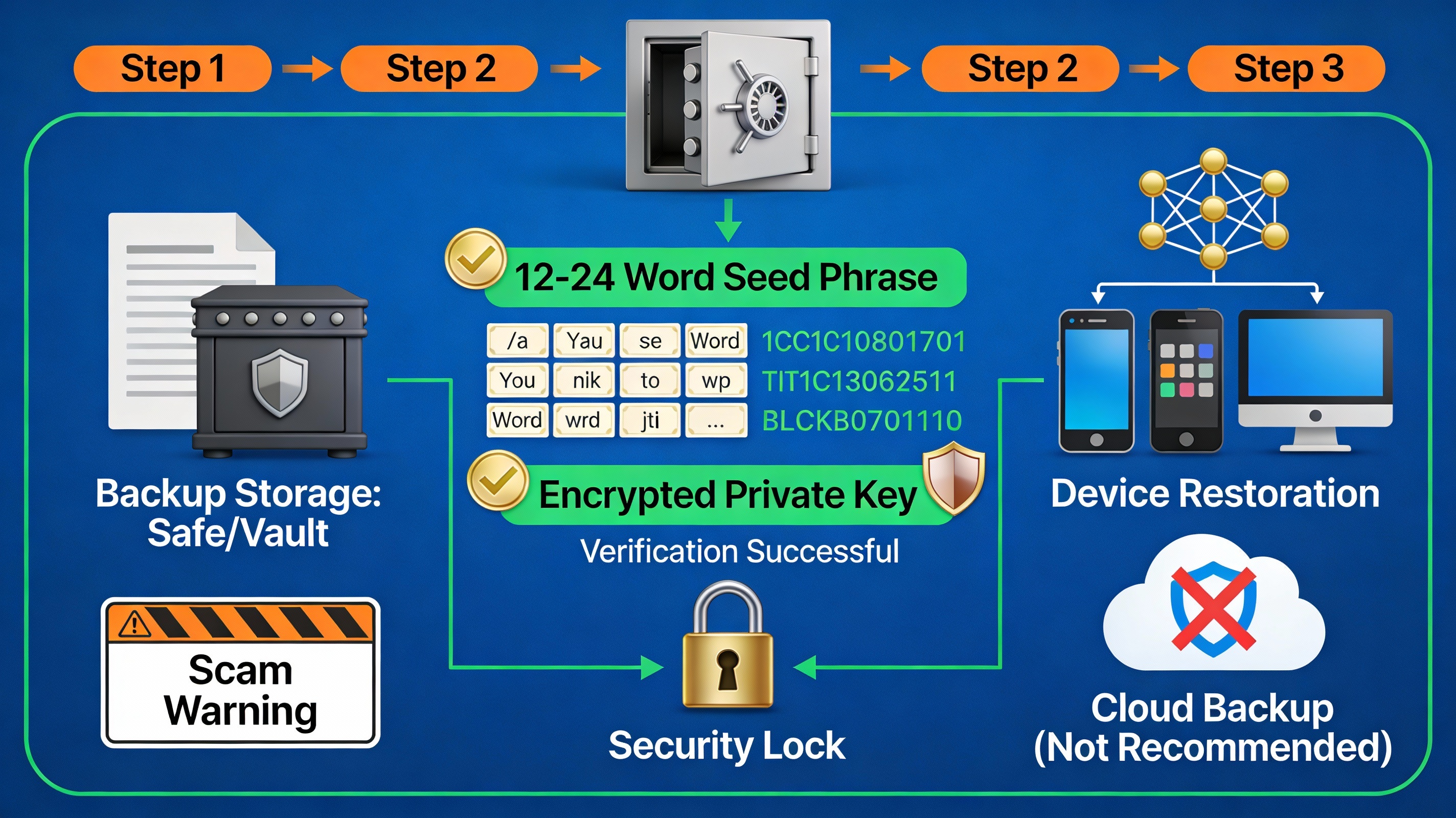

How Do I Recover a Lost Cryptocurrency Wallet?

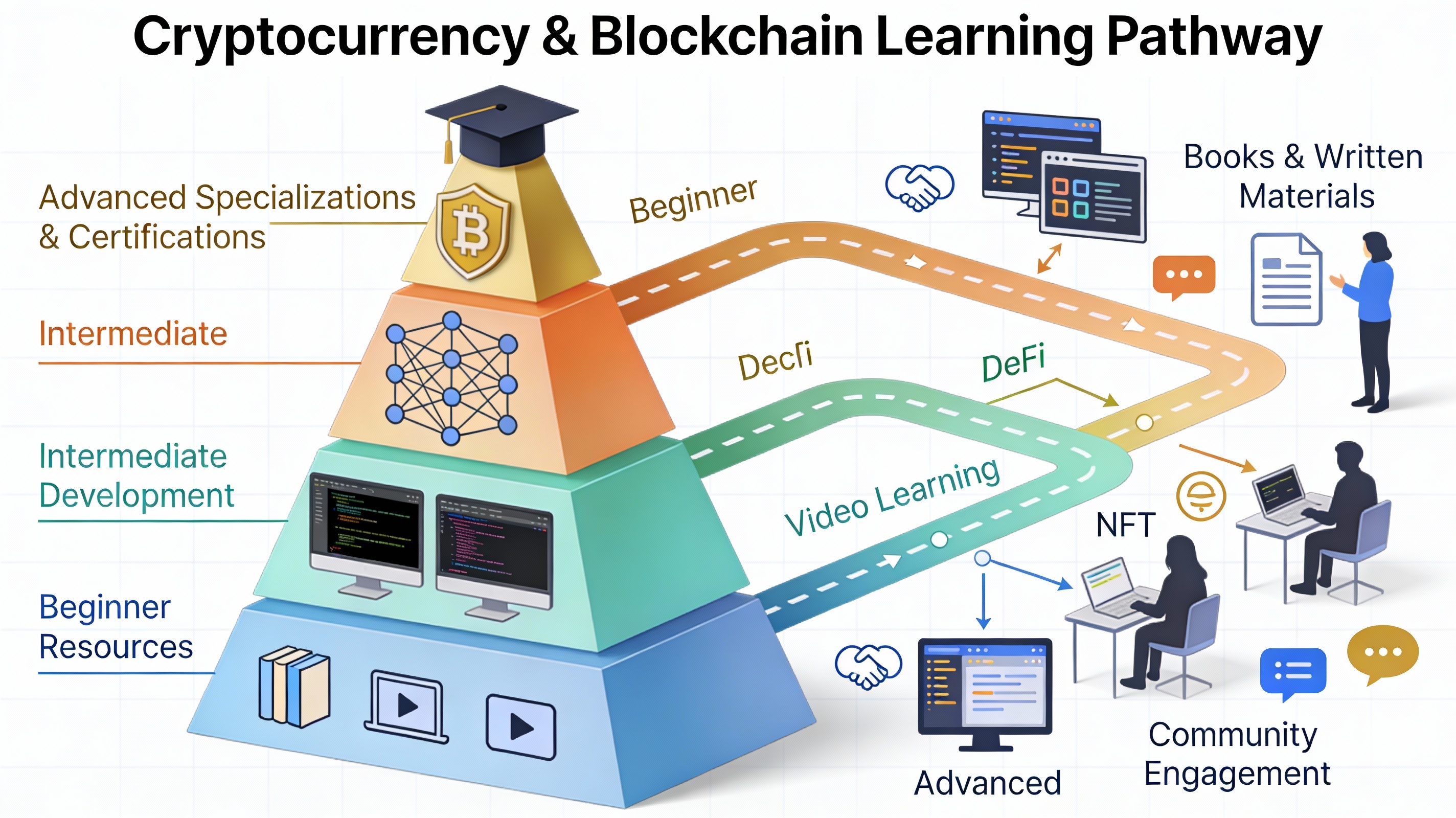

How Can I Learn More About Cryptocurrency and Blockchain Technology?

How Do I Track Cryptocurrency Prices in Real-Time?

Leave a Comment