How Do I Choose the Right Cryptocurrency for Investment?

Learn how to choose the right cryptocurrency for investment. Complete framework covering technology analysis, tokenomics, risk-reward assessment, and portfolio diversification.

With over 50,000 cryptocurrencies in existence and new tokens launching daily, selecting the right digital asset for investment has become exponentially more challenging. In 2025, 80-99.9% of new token launches collapsed from their peak valuations within months, illustrating the catastrophic failure rate of speculative projects. This comprehensive guide provides investors with a structured framework for evaluating cryptocurrencies based on fundamental criteria: technology assessment, team credibility, market adoption, tokenomics analysis, risk-reward ratios, and portfolio alignment. By applying these evidence-based selection criteria, investors can reduce exposure to fraudulent schemes while identifying assets with genuine long-term potential.

Step 1: Clarify Your Investment Goals and Risk Tolerance

Before evaluating specific cryptocurrencies, establish your investment framework.

Define Your Investment Objectives:

Are you seeking capital appreciation through trading? Generating yield through staking or DeFi protocols? Building long-term wealth? Diversifying an existing portfolio? Each objective demands different cryptocurrency selections. A capital appreciation goal might support altcoin exploration, while wealth building typically favors established assets with proven track records.

Assess Your Risk Tolerance:

Cryptocurrency volatility far exceeds traditional assets. Bitcoin has experienced 24-hour price swings of 10-20%, while altcoins routinely move 50%+ in minutes. Establish your personal risk tolerance: What percentage portfolio loss can you emotionally and financially tolerate? This determines whether you should focus on large-cap cryptocurrencies (Bitcoin, Ethereum) or explore smaller, higher-risk assets.

Time Horizon Consideration:

Short-term traders require highly liquid assets with tight spreads and active trading volumes. Long-term investors should prioritize assets with strong fundamentals and genuine use cases rather than speculative momentum plays. A 5-10 year investment horizon dramatically changes optimal cryptocurrency selection compared to a 3-month speculation window.

Position Sizing Framework:

Most financial advisors recommend limiting cryptocurrency to 5-10% of total portfolio value. High-risk investors might allocate 10-15%, while conservative investors should limit exposure to 2-5%. Within your cryptocurrency allocation, further diversify: 60-70% to established assets (Bitcoin, Ethereum), 20-30% to mid-cap projects with proven ecosystems, and only 5-10% to experimental/speculative tokens.

Step 2: Understand Market Capitalization and Trading Volume

Market capitalization and trading volume provide essential context for evaluating cryptocurrency viability.

Market Capitalization Hierarchy:

- Mega-cap (>$500B): Bitcoin, Ethereum - Highest liquidity, lowest volatility, proven long-term viability but lower growth potential

- Large-cap ($50-500B): Established platforms (Solana, BNB, XRP) - Significant adoption, institutional investment, moderate growth potential

- Mid-cap ($5-50B): Emerging ecosystems (Polkadot, Avalanche, Cardano) - Growth potential but greater risk

- Small-cap ($500M-5B): Speculative projects - High growth potential but substantial failure risk

- Micro-cap (<$500M): Extremely speculative - 80-99% probability of total loss

Trading Volume Analysis:

Adequate trading volume ensures you can execute trades at fair prices. Low-volume cryptocurrencies suffer from enormous bid-ask spreads—the difference between buying and selling prices can reach 5-15%, immediately creating losses. A cryptocurrency with $1 million market cap but only $50,000 daily volume is illiquid and potentially impossible to exit during market stress. Minimum daily volume should be 1-2% of market capitalization for reasonable liquidity.

Market Dominance:

Bitcoin and Ethereum together represent approximately 60-70% of total cryptocurrency market capitalization. This concentration means their price movements heavily influence the broader market. Diversifying across different consensus mechanisms, use cases, and ecosystems reduces correlation risk in your cryptocurrency portfolio.

Step 3: Evaluate the Technology Foundation

The underlying technology fundamentally determines a cryptocurrency's long-term viability.

Consensus Mechanism Assessment:

- Proof of Work (PoW): Bitcoin's mechanism. Energy-intensive but provides unmatched security and decentralization. Suitable for store-of-value assets.

- Proof of Stake (PoS): Ethereum's current mechanism. Energy-efficient, scales better, but concentrated stake holders can create centralization risks.

- Delegated Proof of Stake (DPoS): Polkadot, Cosmos. Community voting reduces centralization compared to pure PoS.

- Layer 2 Solutions: Polygon, Arbitrum, Optimism. Built on Ethereum for scalability while inheriting security. Growing adoption but depend on Ethereum's health.

Scalability and Speed:

Bitcoin processes approximately 7 transactions per second; Ethereum historically processed 12-15 (now improving with upgrades). Solana processes 65,000 transactions per second. For cryptocurrency to function as a practical payment system, it must handle comparable volume to traditional payment networks (Visa processes 24,000 transactions per second). Evaluate transaction throughput relative to the project's stated use case.

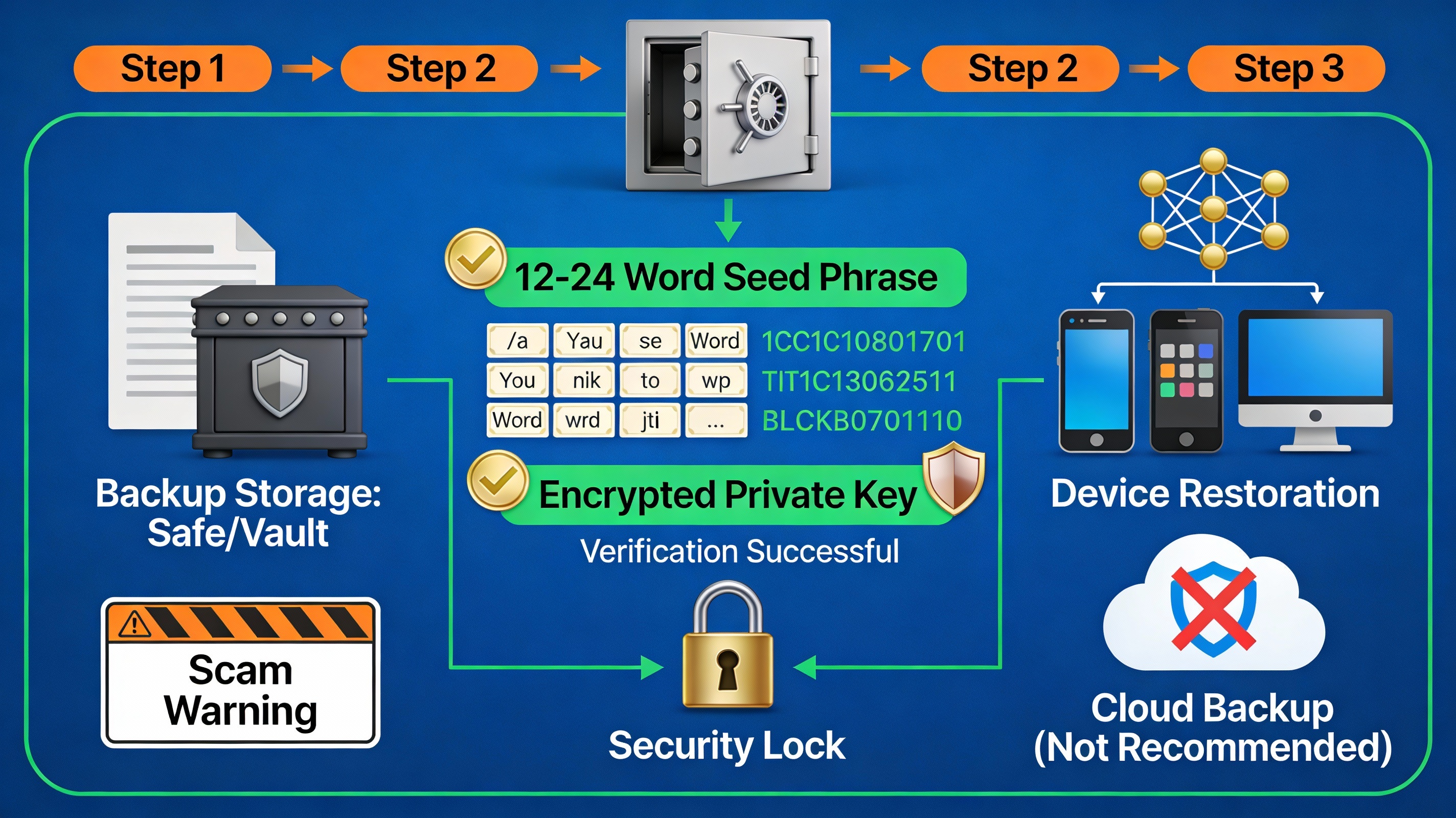

Security and Audit Status:

Smart contract vulnerabilities have caused billions in losses. Before investing in tokens dependent on smart contracts, verify:

- Has the code undergone audits by reputable firms (CertiK, OpenZeppelin, TrailOfBits)?

- Have there been past security incidents? Were they resolved satisfactorily?

- Is the code open-source and subject to community review?

- What is the insurance coverage for smart contract failures?

Decentralization Level:

Evaluate whether the network is genuinely decentralized:

- How many independent validators operate the network?

- Do any entities control >30% of stakes or nodes?

- Is code development controlled by a central organization or distributed among developers?

- Can protocol changes be implemented without consensus from a small group?

Highly centralized cryptocurrencies (founders/companies controlling >20% of tokens or >50% of staking) carry governance risk—key decisions could be made against community interests.

Step 4: Analyze the Whitepaper Thoroughly

The whitepaper is the project's foundational document. Critical evaluation is essential.

Problem and Solution Clarity:

A strong whitepaper clearly identifies the specific problem it solves. Vague statements like "improve blockchain technology" are red flags. Clear projects explain: What existing system is broken? Why are current solutions inadequate? How does this project specifically solve that problem? Is the solution truly better than alternatives?

Technical Depth:

Does the whitepaper provide sufficient technical detail for evaluation? If it relies entirely on buzzwords (AI-powered, quantum-resistant, revolutionary) without technical substance, be skeptical. Legitimate projects explain consensus mechanisms, scalability approaches, security methods, and architectural decisions in detail.

Team and Credibility:

Examine the development team:

- Are team members' identities public and verifiable?

- Do they have prior successful projects?

- Do they have relevant technical expertise?

- Have they disclosed potential conflicts of interest?

Anonymous teams are common in crypto, but higher stakes require identity verification. Compare team credentials to scope of project.

Realistic Roadmap:

Evaluate the development roadmap:

- Are milestones specific and dated?

- Does the team have a track record of meeting previous targets?

- Are goals technically feasible and realistic?

- Are updates provided on progress?

Constantly missed milestones, vague timelines, or unrealistic goals (claiming to revolutionize an industry in 12 months) indicate execution risk.

Tokenomics Analysis:

Examine token distribution and supply:

- Total Supply and Inflation: What is the total token supply? Is there unlimited inflation or a fixed maximum? Bitcoin's 21-million-coin cap creates scarcity, while projects with unlimited supply face inflation risk.

- Distribution Model: How were tokens allocated?

- Founder allocation: >20% to founders/team is concerning

- Investor allocation: What percentage to early investors?

- Community/public allocation: Higher community allocation is more fair

- Locked tokens: Are founder tokens time-locked to prevent immediate dumping?

- Token Utility: What is the token's actual use?

- Voting on governance decisions

- Paying transaction fees

- Staking for network security

- Access to platform features

Tokens without clear utility (pure speculative play) carry higher risk. Compare utility to market price—is the token overvalued relative to its use case?

- Vesting Schedules: When do team and investor tokens unlock? Large unlock events often trigger price crashes as sellers dispose of their shares.

Step 5: Assess Market Adoption and Community

Technology alone doesn't guarantee success. Real-world adoption determines long-term viability.

Active User Base:

- Daily Active Users (DAU): How many unique addresses interact with the protocol daily?

- Transaction Volume: Is transaction volume consistently growing or declining?

- Network Effects: Does the network become more valuable as more users join?

Compare these metrics across similar projects. A cryptocurrency with declining daily users or transactions indicates waning adoption regardless of technical features.

Developer Engagement:

Platforms attracting developer interest signal long-term potential:

- How many active developers contribute to the project?

- What is the rate of code commits (development activity)?

- Are new decentralized applications (dApps) launching on the platform?

- How robust is the developer ecosystem and tooling?

Ethereum dominates with thousands of active developers; newer platforms have much smaller development communities.

Community Health:

- Social Media Engagement: Is discussion genuine or pump-driven?

- Community Governance: Do token holders genuinely influence project direction?

- Partnerships: Are established companies building on or integrating with the platform?

- Academic Research: Are universities researching the technology?

Healthy communities engage in technical discussions and problem-solving rather than pure price speculation.

Regulatory Clarity:

Regulatory environment significantly impacts adoption:

- Has the SEC classified the token as a security or commodity?

- Are institutional investors building on the platform?

- Does the project engage constructively with regulators?

- Are there regulatory risks in major jurisdictions?

Projects with clearer regulatory status (Bitcoin, Ethereum, Cardano) have lower regulatory risk than projects with unclear legal status.

Step 6: Calculate Fundamental Valuation Metrics

Apply fundamental analysis to estimate fair value.

Market Cap to Total Value Locked (TVL) Ratio:

For DeFi platforms, compare market capitalization to total value locked (TVL—actual cryptocurrency in use on the platform):

- If market cap >> TVL: Token is overvalued relative to actual use

- If TVL > market cap: Token is undervalued relative to usage

Example: A DeFi platform with $50 billion market cap but $500 million TVL suggests extreme overvaluation—users don't trust their capital to the platform despite massive market value.

Network Value to Transactions (NVT) Ratio:

Similar to the price-to-earnings (P/E) ratio in traditional finance, NVT compares market value to transaction volume. Lower NVT suggests a more efficient network where high value is transacting through the ecosystem. Compare NVT across similar cryptocurrencies to identify relative valuation.

Price to Sales (Tokenomics):

If the cryptocurrency generates revenue (transaction fees, platform revenue), calculate price-to-sales:

- Price (market cap) / Annual Revenue

Compare across similar projects. A project with $100 billion market cap generating $50 million annual revenue (P/S of 2,000) is far more expensive than a project with $100 million market cap generating $1 million annual revenue (P/S of 100).

Token Velocity:

High token velocity (frequent trading) can suppress prices as tokens change hands constantly. Low velocity (tokens held) supports prices through scarcity. Calculate: Total transaction volume / Average network value. Projects with lower velocity relative to similar assets may have better price support.

Discount to All-Time High (ATH):

Where is the current price relative to the all-time high? A 70% discount to ATH might indicate either undervaluation or justified price destruction:

- Established projects (Bitcoin, Ethereum) trading 40-60% below ATH during bear markets often recover

- New projects (2025 launches) trading 80-99% below ATH rarely recover and represent destroyed value

Step 7: Perform Risk-Reward Analysis

Quantify potential upside against downside risk.

Define Risk Parameters:

- Maximum loss tolerance: At what price will you exit to limit losses? (Stop-loss level)

- Profit target: At what price will you capture profits? (Take-profit level)

- Time horizon: Over what period do you expect returns?

Calculate Risk-Reward Ratio:

Risk-Reward Ratio = Potential Profit / Potential Loss

Example:

- Current price: $100

- Stop-loss: $80 (20% downside)

- Profit target: $150 (50% upside)

- Risk-Reward Ratio = 50 / 20 = 2.5:1

For every dollar risked, potential profit is $2.50. Most professional investors target minimum 2:1 or 3:1 ratios—potential reward at least 2-3x potential risk.

Evaluate Probability:

A 3:1 risk-reward ratio is meaningless if success probability is <25%. Assess:

- What is the probability this cryptocurrency reaches your profit target?

- What catalysts would drive that appreciation?

- How likely are those catalysts to materialize?

Expected Value = (Probability of Profit × Profit Amount) - (Probability of Loss × Loss Amount)

Only pursue trades with positive expected value.

Step 8: Diversification and Portfolio Construction

Avoid concentrated positions in single cryptocurrencies.

Diversification Strategy:

- Layer 1 Blockchains: Bitcoin, Ethereum, Solana, Cardano, Polkadot

- DeFi Tokens: Compound, Aave, Uniswap, Curve

- Payment Tokens: Ripple (XRP), Monero, Litecoin

- Specialized: Chainlink (oracle), Render (GPU computing), Filecoin (storage)

- Stablecoins: USDC, DAI (for risk management)

Allocation Framework:

- Core Holdings (60-70%): Bitcoin, Ethereum - fundamental anchors

- Established Alts (20-30%): Proven smart contract platforms with years of adoption

- Experimental (5-10%): Emerging projects with higher growth potential but greater risk

- Stables/Cash (5-10%): USDC, USDT, or stablecoins for downturns

This structure provides exposure to growth while limiting catastrophic loss potential.

Rebalancing:

As cryptocurrencies appreciate at different rates, periodically rebalance toward your target allocation. This forces buying underperforming assets and selling overperformers—a discipline that improves long-term returns.

Step 9: Monitor Key Metrics Continuously

Cryptocurrency investment requires ongoing evaluation.

On-Chain Metrics:

- Active Addresses: Are daily active users growing or declining?

- Transaction Count: Is network activity increasing?

- Exchange Inflows/Outflows: Are investors accumulating or distributing?

- Whale Activity: Are large holders buying or selling?

Development Metrics:

- Code Commits: Is development ongoing and active?

- GitHub Activity: Are developers regularly improving the project?

- Upgrade Proposals: Are new features being implemented?

Market Metrics:

- Price Volatility: Is volatility increasing (warning sign) or decreasing (stabilization)?

- Volume Trends: Is trading volume supporting or abandoning the asset?

- Correlation: Is the asset moving independently or tracking Bitcoin exactly?

Step 10: India-Specific Considerations

For Indian investors, additional factors apply:

Regulatory Framework:

- RBI discourages cryptocurrency use but hasn't banned it

- Crypto transactions are taxable under income/capital gains tax

- PMLA (Prevention of Money Laundering Act) applies to crypto transactions

- Some exchanges face RBI pressure, creating custody risk

Exchange Selection:

Use regulated platforms with proper KYC:

- Kraken India (regulated)

- Giottus (Indian exchange with strong compliance)

- CoinDCX (Indian exchange)

- Zebpay (Indian exchange)

Avoid unregulated P2P platforms—counterparty risk is extreme.

Tax Compliance:

- Every crypto transaction creates a taxable event

- Staking rewards are taxable

- Maintain detailed records for tax filing

- Consult a tax professional familiar with crypto

Rupee Ramp Considerations:

Using INR on-ramps (converting rupees to crypto) on regulated exchanges is safest. P2P exchanges introduce fraud risk.

A Systematic Approach to Cryptocurrency Selection

Choosing the right cryptocurrency requires systematic evaluation across technology, team, adoption, valuation, and risk dimensions. The framework outlined in this guide moves beyond speculation toward evidence-based investment decisions.

The harsh reality is clear: 80-99.9% of 2025 token launches collapsed from peak valuations. This catastrophic failure rate underscores the importance of rigorous selection criteria. Bitcoin and Ethereum, despite their age, remain the most defensible positions due to proven technology, network effects, regulatory clarity, and institutional adoption.

For growth-oriented investors, diversified exposure to established smart contract platforms (Solana, Cardano, Polkadot) with active developer ecosystems and real use cases offers better risk-adjusted returns than chasing the latest launch hype.

The most successful cryptocurrency investors apply discipline: clear investment objectives, systematic risk assessment, diversified portfolios, and continuous monitoring. Emotion-driven speculation and FOMO (fear of missing out) have destroyed far more capital than disciplined, framework-based selection ever has.

Comments 0

Most Read

What Is the Concept of Tokenization in Blockchain?

Bitcoin & Ethereum Market Momentum Update

Recommended Post

What Is the Concept of Tokenization in Blockchain?

How Do I Avoid Common Mistakes When Trading Cryptocurrencies?

How Do I Recover a Lost Cryptocurrency Wallet?

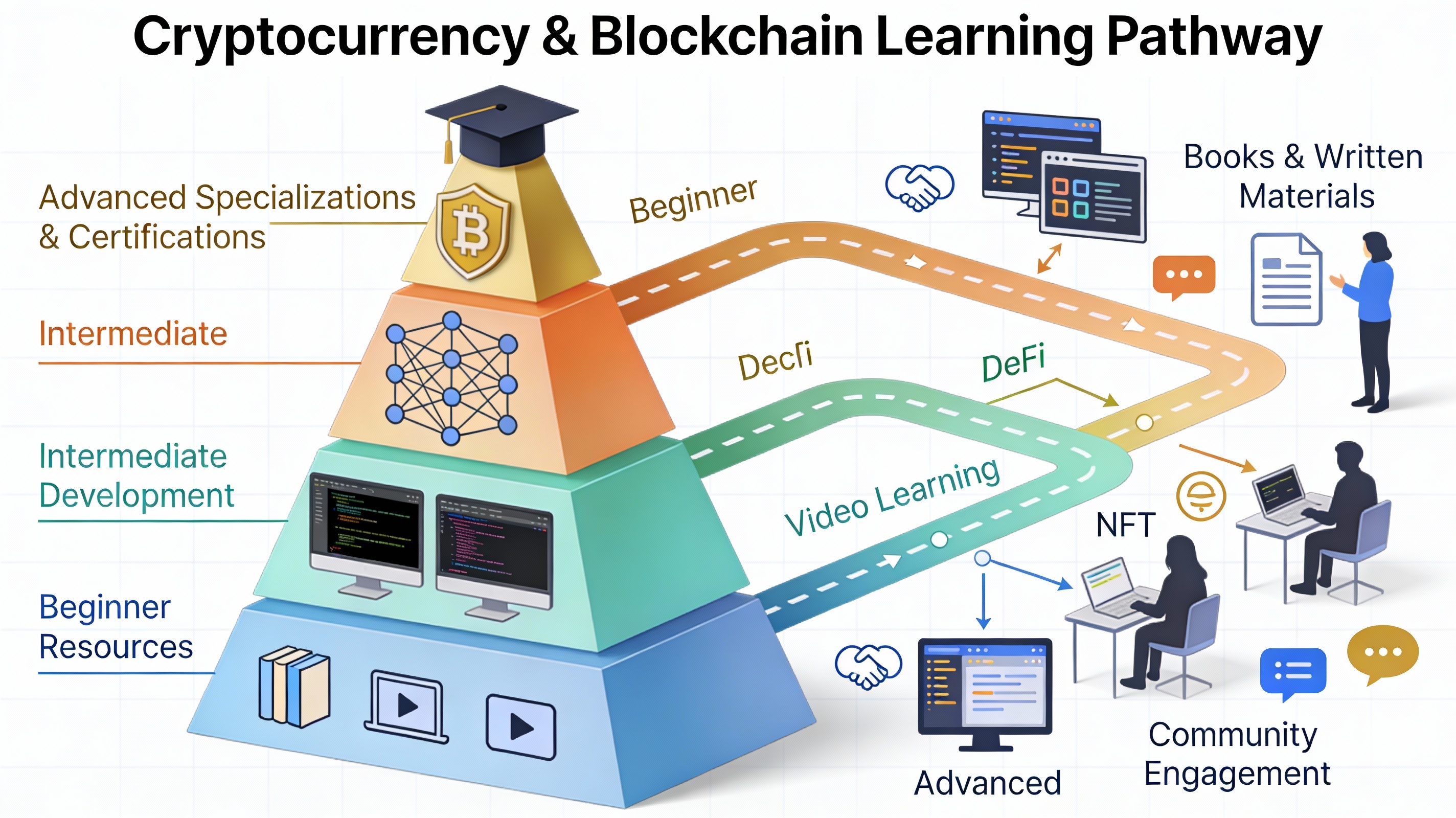

How Can I Learn More About Cryptocurrency and Blockchain Technology?

How Do I Track Cryptocurrency Prices in Real-Time?

Leave a Comment