What Are the Risks Associated with Cryptocurrency Investments? A 2026 Comprehensive Guide

Comprehensive guide to crypto investment risks. Learn about volatility, hacks, scams, regulatory changes, and smart contract vulnerabilities that threaten your portfolio.

Cryptocurrency has emerged as a significant asset class with over $1.4 trillion in global market capitalization, yet it remains one of the most volatile and risky investment categories available. In 2025, crypto investors faced unprecedented challenges: $4 billion in total ecosystem losses (a 39% increase from 2024), over $333 million in Bitcoin ATM scams alone, and a spike in AI-driven security exploits surging 1,025%. This comprehensive guide analyzes the multifaceted risks surrounding cryptocurrency investments, from extreme market volatility to sophisticated cyber attacks, regulatory uncertainty, and increasingly prevalent fraud schemes. Understanding these risks is essential before allocating capital to digital assets.

The Volatility Risk: Understanding Extreme Price Swings

Cryptocurrency markets exhibit volatility levels far exceeding traditional financial assets. Bitcoin, the most established cryptocurrency, has historically demonstrated 24-hour price swings of 10-20%, while smaller altcoins can move 50% or more in minutes. This volatility poses two fundamental problems for investors: the risk of catastrophic losses and the difficulty of accurate portfolio valuation and risk assessment.

Historical Volatility Patterns:

Bitcoin reached $19,783 in December 2017, only to collapse to $6,800 by February 2018—a 66% loss in less than two months. Similarly, the 2021-2022 bear market saw Bitcoin fall from $68,000 to $16,500. These aren't anomalies; they represent the normal operational reality of crypto markets. A $100,000 investment at the wrong time can become $35,000 in weeks.

Factors Driving Volatility:

Cryptocurrency markets operate without many of the regulatory safeguards that prevent extreme price movements in traditional markets. Unlike stock exchanges that employ circuit breakers to halt trading during sharp declines, crypto markets trade continuously—24/7 across global time zones. This creates cascading effects where market movements in one region trigger panic selling in others before institutional circuit breakers could activate.

Sentiment-driven trading dominates crypto markets, with retail traders comprising 70-80% of trading volume. A single negative news item about regulatory action, exchange hack, or influencer statement can trigger "flash crashes" where billions in assets are liquidated in minutes. The October 2025 crash demonstrated this vividly: over $19 billion in leveraged positions were liquidated in roughly 24 hours, sending prices through support levels and triggering margin call spirals that hurt even profitable traders.

Investor Implications:

The risk of losing your entire investment in cryptocurrency is not theoretical—it's a documented possibility. Investors who purchased near $20,000 Bitcoin in 2017 faced 65% losses if they sold near the March 2020 COVID crash. More concerning, investors in altcoins (smaller cryptocurrencies) face even greater losses, with the vast majority of new crypto projects failing entirely.

Market Manipulation and Liquidity Risk

Cryptocurrency markets are significantly less liquid than traditional capital markets, creating opportunities for manipulation and sudden price disconnections from fundamental value.

Pump-and-Dump Schemes:

The crypto market's lower liquidity enables "pump-and-dump" operations where larger traders ("whales") accumulate positions, then execute coordinated buying to drive prices upward, attracting retail investors. Once significant volume is trapped, whales sell their holdings, crashing the price and leaving retail investors with losses. SlowMist data indicates this remains a prevalent tactic, particularly in altcoin markets where individual accounts can move prices by 5-10% with single trades.

Liquidity Vacuum Risk:

During market stress, liquidity in cryptocurrency markets evaporates dramatically. Trading spreads (the gap between buy and sell prices) can widen from 0.1% to 5% in seconds. This means if you place a market order to sell during a crash, you'll receive significantly worse prices than displayed. The October 2025 crypto crash revealed that certain exchanges' internal pricing diverged 5-10% from cross-venue prices, forcing liquidations of solvent positions simply due to venue-specific price feeds.

Illiquidity in Smaller Assets:

For altcoins and new tokens, liquidity is even more constrained. Trying to sell a large position can move prices 20-50%, meaning sophisticated traders use algorithmic techniques to minimize market impact. For retail investors holding illiquid assets, this can mean being unable to exit positions at any reasonable price during market stress.

The Regulatory Risk: Shifting Legal Frameworks

The regulatory landscape for cryptocurrency remains fundamentally uncertain. Governments worldwide are implementing conflicting approaches, creating compliance risks and unpredictable disruption to market operations.

Regulatory Crackdowns and Market Impact:

The May 2021 Bitcoin price crash coincided with China's renewed prohibition on crypto mining and trading. Regulatory announcements from the SEC, CFTC, or central banks consistently trigger 10-15% price movements. The 2024-2025 period exemplified this: early positive regulatory clarity under the Trump administration drove prices up, but regulatory uncertainty from CFTC leadership instability (operating with only 2 of 5 commissioners) has created unpredictable enforcement patterns.

Global Regulatory Divergence:

While the United States has moved toward clearer crypto frameworks, the European Union's Markets in Crypto-Assets (MiCA) regulation created a regulatory bottleneck that forced 75% of European crypto service providers to lose their licenses by year-end. China maintains complete prohibition. Russia and Pakistan maintain opaque regulatory stances that change suddenly. This creates uncertainty: a position that's legal in Singapore could be prohibited in the EU within months.

Risk to Custodial Services:

Regulatory changes can immediately affect the custodians and exchanges holding your assets. When El Salvador adopted Bitcoin as legal tender in 2021, followed by regulatory clarity, institutional investors were encouraged to participate. But when Japan reclassified certain tokens, multiple exchanges delisted them overnight, preventing customers from trading. If your crypto is held on an exchange that loses its license, recovery of funds can be prolonged or incomplete.

Security Breaches and Custodian Risk: The Centralization Paradox

Despite decentralized finance technology, most crypto investors hold assets on centralized exchanges or through custodian services. These intermediaries represent massive security targets.

2025 Security Breach Statistics:

The crypto industry experienced unprecedented hacking losses in 2025. The Bybit exchange suffered a $1.5 billion hack attributed to North Korean-linked actors, representing the largest single theft in crypto history. Across the industry, centralized exchange breaches accounted for $1.8 billion in losses in 2025 alone. In the first half of 2025, $2.17 billion was stolen—already exceeding the entire 2024 total with half the year remaining.

Personal Wallet Compromise:

Beyond exchange hacks, personal wallet compromises represent an increasing vulnerability. By mid-2025, personal wallet compromises constituted 23.35% of all stolen fund activity. A single social engineering attack against an individual yielded $330 million in Bitcoin theft. Phishing attacks, though they declined 83% to $83.85 million in 2025, still victimized 106,106 people. For comparison, traditional financial fraud on this scale would be nearly impossible due to layered protections.

Operational Security Failures:

The crypto industry faces a "multi-signature crisis" where sophisticated security features are undermined by operational failures. In 2025, Safe multisig wallets suffered repeated compromises despite the underlying cryptographic design being sound. The vulnerabilities stemmed from weak operational processes: developers storing keys on everyday laptops, inadequate access controls, and single points of failure in signing workflows.

Custodian Insolvency Risk:

When crypto custodians fail—a scenario demonstrated by FTX (2022), Celsius (2022), and others—customer funds are often unrecoverable. Unlike traditional banks where deposits up to certain limits are insured by government programs (FDIC in the U.S.), crypto custodians often hold customer assets without segregating them or maintaining adequate reserves. The FTX collapse demonstrated that a custodian's balance sheet can be completely opaque, with billions borrowed from customer deposits for proprietary trading.

Rug Pulls and Token Fraud: The Scam Risk

Rug pulls—where developers create cryptocurrencies, attract investor capital, then disappear with funds—represent one of cryptocurrency's most persistent fraud vectors.

How Rug Pulls Work:

Developers launch a token with marketing promising exceptional returns. They pair it with an established cryptocurrency on a decentralized exchange (e.g., ETH/NEWTOKEN with 50% of liquidity in ETH). As investors buy the new token, its price rises. When the liquidity pool reaches significant value, developers drain the ETH portion of the liquidity, making the token impossible to sell (no ETH to trade against) and worthless.

Notable Rug Pull Examples:

- Squid Game Token (2021): $3.4 million disappeared

- AnubisDAO (2021): $60 million drained

- Meerkat Finance (2021): $31 million vanished

- LIBRA Rugpull (2025): $300 million insider-driven theft

Detection Challenges:

Identifying potential rug pulls before they occur is extremely difficult. Warning signs include:

- Anonymous developers with no verifiable identity

- No smart contract security audits

- Unrealistic return promises (30-50%+ annual yields)

- Unlocked liquidity pools (developers retain withdrawal rights)

- Sudden, unexplained price spikes

- Poorly written or unaudited smart contracts

Even investors doing research can be fooled. High-profile tokens with legitimate-appearing teams have executed rug pulls. The asymmetric information advantage favors scammers: they know the exit date while investors speculate.

Smart Contract and Technological Risks

Many crypto investments, particularly in decentralized finance (DeFi), depend on smart contracts—programs executing financial transactions. These are subject to numerous security vulnerabilities.

Smart Contract Vulnerability Categories:

- Reentrancy Attacks: The 2016 DAO hack exploited this vulnerability to drain $50 million, demonstrating that even well-intentioned projects can suffer catastrophic hacks due to coding errors.

- Access Control Flaws: Unprotected functions allowed attackers to drain funds from various protocols, causing $15 million in losses in recent years. The KiloEx exchange suffered a $7 million loss purely from missing access controls.

- Oracle Manipulation: Smart contracts rely on external data sources ("oracles") for prices and information. Attackers can manipulate these feeds, triggering false contract execution. Flash loan attacks exploit temporary price anomalies to borrow enormous sums, manipulate prices, and profit before repayment.

- Front-Running and Extraction: Attackers observe pending transactions in the blockchain mempool, insert their own transactions before them, and extract value. This affects approximately 20-25% of DeFi transactions.

- Immutable Bugs: Once deployed, smart contracts cannot be changed. A $500 million bug in Ethereum smart contracts resulted in permanent, irrevocable loss of user funds with no recovery mechanism.

2025 DeFi Losses:

Despite multiple security audits, major DeFi exploits continued in 2025. The Cetus Protocol suffered a $230 million hack, and Balancer V2 lost $121 million. Critically, several of the largest DeFi exploits affected projects with multiple professional audits, indicating that security audits don't guarantee contract safety.

Leverage and Margin Trading Risks: Bankruptcy Through Liquidation

Cryptocurrency exchanges offer leveraged trading where traders can borrow funds to amplify position sizes. 100x leverage is available on some platforms, meaning a 1% price movement results in a 100% loss of collateral.

Liquidation Mechanics:

When using leverage, exchanges set maintenance margin requirements (often 0.5%). If your account equity falls below this threshold due to price movements, the exchange automatically liquidates (closes) your position at market prices—often during the worst possible moments. A trader with 10x leverage on Bitcoin experiences total account wipeout if Bitcoin falls 10%. Worse, liquidation can occur at prices far worse than your limit orders due to network congestion and slippage.

October 2025 Liquidation Cascade:

The October 10, 2025 crash exemplified leverage risks. A tariff announcement triggered a global sell-off. Crypto markets, trading 24/7 without circuit breakers, experienced rapid liquidations. Over $19 billion in leveraged positions were liquidated in roughly 24 hours. Many traders holding "hedged" positions found their short positions closed via automatic deleveraging (ADL) mechanisms to cover losses, converting hedged portfolios into naked positions—the opposite of risk reduction.

Velocity and Irreversibility:

Unlike traditional markets where trading halts protect investors, crypto liquidations occur in seconds. A trader cannot "call the exchange" to discuss margin position. Algorithms execute liquidation before human traders can react. The October 2025 analysis noted that traders using 20-50x effective leverage face risks that "lie not in directional bets but in scenarios where liquidity disappears and exchange infrastructures turn unreliable."

Counterparty and Custody Risks

Most crypto investors don't directly control their private keys; instead, they trust custodians and exchanges.

Counterparty Risk Definition:

Counterparty risk is the possibility that the entity holding your assets fails through security breaches, insolvency, mismanagement, or fraud. In crypto, this risk is substantial because:

- No Capital Requirements: Unlike regulated banks required to maintain specified capital ratios, crypto custodians often operate with minimal equity. If a custodian loses even 10% of assets through hacking, it can become insolvent, with customer funds unrecoverable.

- No Deposit Insurance: Traditional bank deposits are insured up to $250,000 by the FDIC. Crypto deposits have no government insurance. Private insurance exists but is limited and expensive.

- Asset Segregation Issues: In traditional finance, custodians maintain strict legal separation between customer assets and their own. Crypto custodians often comingle funds or use customer deposits for proprietary trading (the FTX model).

- Jurisdictional Complications: Crypto custodians frequently operate offshore in jurisdictions with weak regulatory oversight. If a Cayman Islands-registered custodian fails, customer recovery may be impossible despite legal rights.

Due Diligence Requirements:

Investors must assess custodian financial health—audited financial statements, capital adequacy, independent security assessments, and regulatory licensing. Most retail investors have no access to this information; they simply use popular exchanges. The collapse of FTX revealed that even institutional investors with resources couldn't detect $8 billion in misappropriation.

Regulatory Compliance and Tax Risks

Tax authorities worldwide are dramatically increasing cryptocurrency reporting requirements and enforcement.

Tax Compliance Complexity:

Cryptocurrency tax treatment varies radically by jurisdiction:

- United States: Every crypto transaction (crypto-to-crypto trades, staking rewards, mining) is taxable. Form 1040 requires all taxpayers to report whether they engaged in crypto activity—no de minimis threshold applies.

- Germany: Long-term crypto holdings (>12 months) are tax-free for individuals

- UK: Crypto gains above annual exemption are taxed as income

- Singapore: No capital gains tax, but mining/trading may face income tax

A crypto-to-crypto trade that's tax-free in Germany triggers capital gains tax in the U.S. This complexity creates compliance risks: an investor might unknowingly violate U.S. tax law.

International Reporting Standards:

The OECD's Common Reporting Standard for Crypto-Assets (CARF) and EU's Directive on Administrative Cooperation (DAC8) require crypto service providers to report customer transactions automatically to tax authorities. This means tax authorities now have visibility into previously anonymous transactions.

Penalties for Non-Compliance:

Non-compliance penalties are severe:

- FBAR (Foreign Bank Account Reporting) penalties: up to $16,536 per account per year for non-willful violations, 50% of account value for willful violations

- Form 8938 penalties: $10,000+ for non-disclosure

- Criminal prosecution: Tax evasion convictions resulting in prison time for significant non-compliance

Recent trends show that tax authorities are increasingly referring crypto non-compliance to criminal prosecution rather than merely assessing civil penalties.

Crypto Fraud and Scams: Beyond Rug Pulls

Beyond rug pulls, crypto attracts diverse fraud schemes.

Bitcoin ATM Scams:

In 2025, scammers stole $333 million through Bitcoin ATM fraud—a 33% increase from 2024. The scam typically involves criminals social engineering targets with fake investment opportunities, romance scams, or impersonation, then directing victims to Bitcoin ATMs to "transfer money." Once crypto is sent, it's irreversible.

AI-Powered Attacks:

In 2025, AI-related security incidents surged 1,025%, primarily targeting insecure APIs and integrated AI agents. Scammers now use AI to generate convincing phishing emails and execute social engineering attacks more effectively.

Fake Wallets and Exchanges:

Scammers create counterfeit websites and mobile apps mimicking legitimate wallets and exchanges. Users unknowingly enter private keys or seed phrases into fake applications, resulting in immediate asset theft.

Social Engineering and Recruitment Scams:

Fraudsters pose as Web3 company recruiters, offering employment and requesting VPN credentials and SSO access. Once granted, attackers use these credentials to access personal crypto holdings or employer crypto infrastructure.

Concentration Risk and Emerging Asset Risk

Cryptocurrency markets are increasingly concentrated in a few major assets. Bitcoin and Ethereum represent approximately 60-70% of the total crypto market capitalization, while the remaining thousands of cryptocurrencies share the remainder. This concentration creates systematic risk.

Altcoin Extinction Risk:

The vast majority of altcoins launched annually fail completely. Projects with promising whitepapers and teams often fail due to failed execution, market competition, or loss of developer interest. Investors betting on smaller cryptocurrencies face the realistic prospect of total loss.

Speculative Asset Risk:

Certain sectors, particularly memecoins, NFTs, and tokens launched purely for speculation, carry extreme risk. These assets have no cash flows, no discounted cash flow valuation model applicability, and prices depend entirely on investor sentiment. The Trump memecoin (World Liberty Financial) raised $500 million with 75% of proceeds benefiting insiders, exemplifying how speculative assets attract fraud.

Market Sentiment and Behavioral Risk

Cryptocurrency markets are heavily influenced by social media sentiment, celebrity endorsements, and retail trader coordination.

Pump-and-Dump via Influencers:

Influencers with large followings can artificially drive token prices by promoting them, leading to coordinated buying. Once prices spike, influencers sell, leaving followers with losses. These schemes are difficult to prosecute as they technically don't fit legal pump-and-dump definitions.

FOMO-Driven Investment Decisions:

Fear of missing out (FOMO) drives retail investors to buy near market peaks, then panic sell near bottoms. This behavioral dynamic exacerbates volatility and increases losses for retail investors.

Risk Mitigation Strategies

While cryptocurrency carries substantial risks, informed investors can mitigate exposure through:

- Position Sizing: Limit crypto to 5-10% of total investment portfolio, proportional to risk tolerance

- Diversification: Avoid concentrated bets on single tokens; hold multiple assets or index strategies

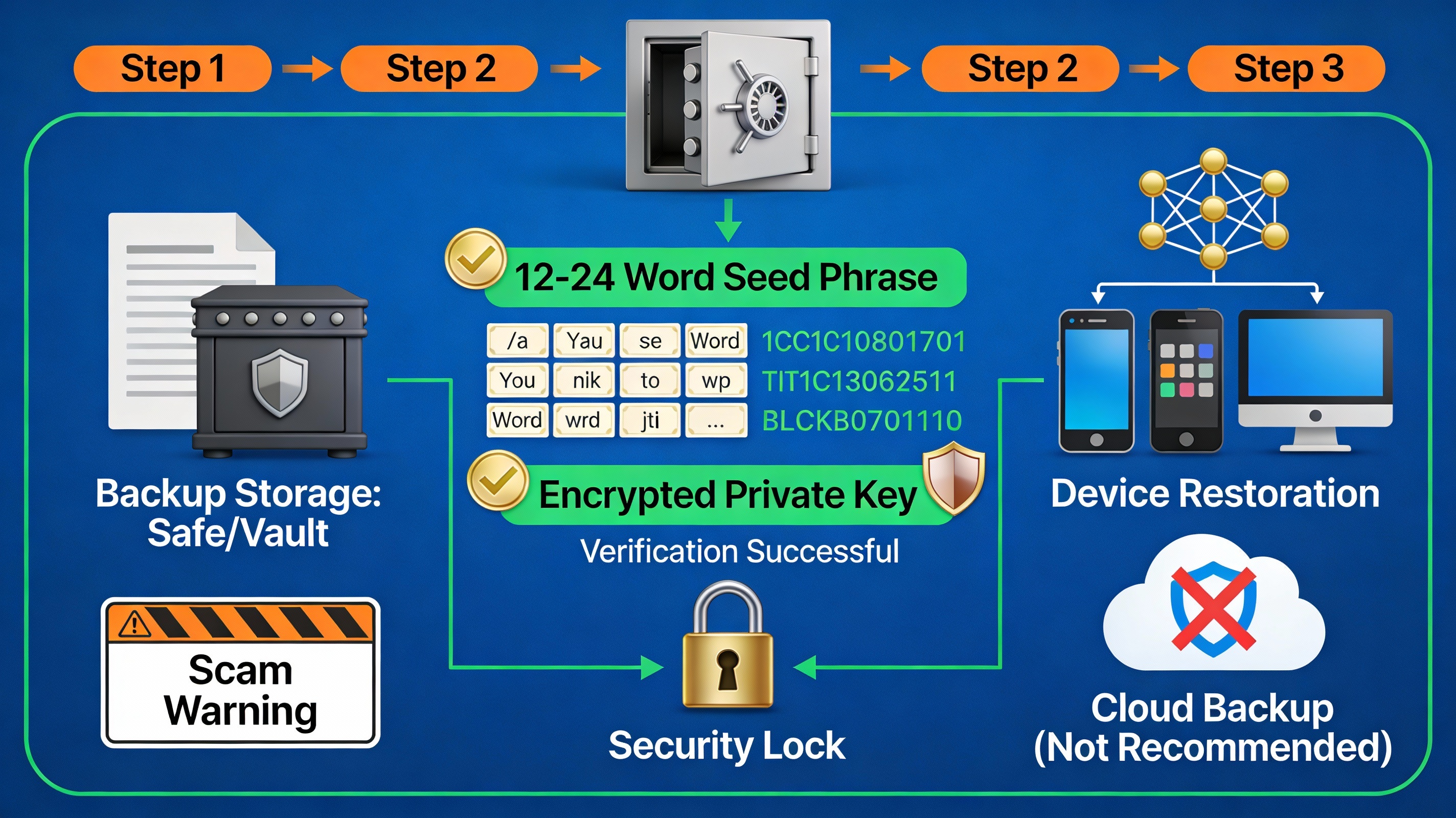

- Cold Storage: Use hardware wallets for holdings exceeding trading amounts, reducing custodian risk

- Avoid Leverage: Refrain from leveraged trading until mastering risk management fundamentals

- Due Diligence: Research projects, verify team identities, confirm security audits before investing

- Tax Compliance: Implement robust record-keeping for tax purposes; consult tax professionals

- Regulatory Awareness: Monitor regulatory developments in your jurisdiction; understand changing compliance requirements

- Professional Custody: Use institutionally-regulated custodians for significant holdings, prioritizing segregation and insurance

Risk-Adjusted Perspective

Cryptocurrency investments carry risks substantially exceeding traditional assets. The combination of extreme volatility, regulatory uncertainty, prevalent fraud, security vulnerabilities, and leverage availability creates an environment where total capital loss is a realistic possibility, particularly for less experienced investors.

The $4 billion in losses suffered by the crypto ecosystem in 2025 alone illustrates that these aren't theoretical risks—they materialize daily for real investors. Understanding and respecting these risks is prerequisite to responsible cryptocurrency investing. For investors with high risk tolerance, proper position sizing, and commitment to ongoing education, cryptocurrency can represent a portfolio diversifier. For those seeking capital preservation or stable returns, cryptocurrency is fundamentally inappropriate.

Comments 0

Most Read

What Is the Concept of Tokenization in Blockchain?

Bitcoin & Ethereum Market Momentum Update

Recommended Post

What Is the Concept of Tokenization in Blockchain?

How Do I Avoid Common Mistakes When Trading Cryptocurrencies?

How Do I Recover a Lost Cryptocurrency Wallet?

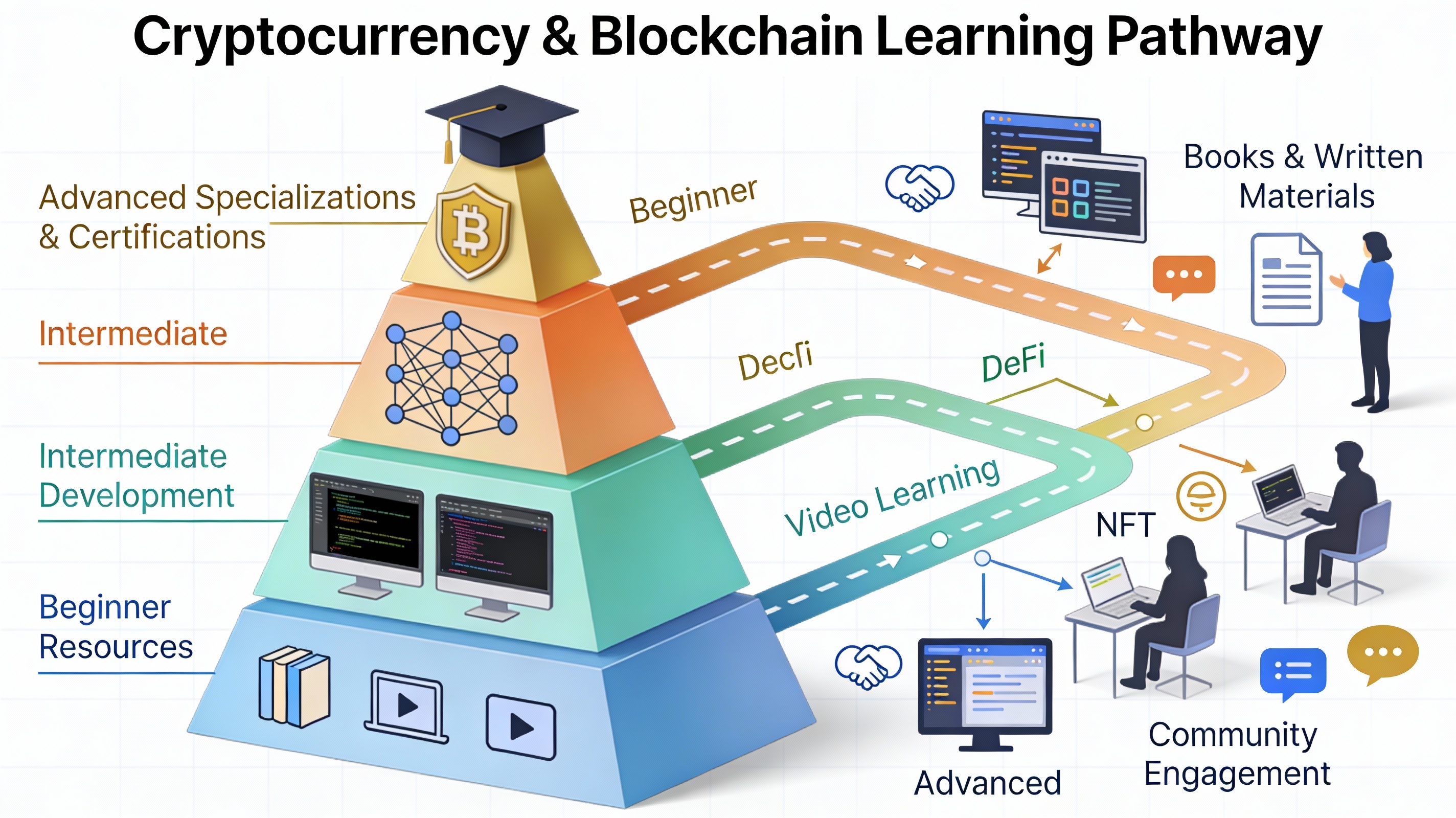

How Can I Learn More About Cryptocurrency and Blockchain Technology?

How Do I Track Cryptocurrency Prices in Real-Time?

Leave a Comment