How Do I Track Cryptocurrency Prices in Real-Time?

Real-time cryptocurrency price tracking guide 2026: Learn how to monitor Bitcoin, Ethereum, altcoins using best platforms, mobile apps, alerts, APIs, and blockchain explorers.

Real-time cryptocurrency price tracking has evolved from specialized trader tools into accessible, user-friendly platforms serving millions of investors daily. In 2025, tracking cryptocurrency prices involves multiple approaches: dedicated tracking platforms (CoinGecko, CoinMarketCap, Merlin Crypto), mobile applications, programmatic APIs, price alert systems, and blockchain explorers. Bitcoin's current range ($88,000-$89,000 USD), Ethereum's continuous volatility, and thousands of altcoins generate continuous price discovery across hundreds of exchanges. This comprehensive guide provides investors and traders with systematic approaches to monitor cryptocurrency prices with appropriate tools, alert mechanisms, and integration strategies based on specific investment objectives.

Understanding Real-Time Cryptocurrency Price Tracking

Cryptocurrency prices fluctuate continuously across multiple exchanges, creating challenges and opportunities for investors. Unlike traditional stock markets with centralized pricing, cryptocurrencies trade on hundreds of decentralized and centralized exchanges simultaneously, often with significant price variations between platforms. Real-time tracking aggregates this fragmented data to provide unified, transparent price information.

Why Real-Time Tracking Matters:

Market opportunities in cryptocurrency appear and disappear within minutes. Bitcoin experienced 10-20% price swings within 24-hour periods. Altcoins routinely move 50%+ in shorter timeframes. Without real-time tracking, investors miss time-sensitive opportunities, fail to execute stop-losses, and become exposed to catastrophic losses. Price discovery happens in real-time; delayed information creates information asymmetry disadvantaging slower participants.

Key Data Points Available:

- Current price across multiple exchanges

- 24-hour high/low price ranges

- Trading volume (24-hour and exchange-specific)

- Market capitalization

- Price change percentages (1h, 24h, 7d, 30d, 1y)

- Bid-ask spreads (buy/sell pressure)

- Technical indicators (moving averages, RSI, MACD, Bollinger Bands)

- On-chain metrics (active addresses, transaction volume, whale movements)

- Liquidity and order book depth

- Historical price data for technical analysis

Method 1: Web-Based Price Tracking Platforms

Web-based platforms provide instant access to cryptocurrency prices without installation or authentication complexities.

CoinGecko (Free, Comprehensive)

CoinGecko aggregates price data from multiple exchanges, providing free access to 10,000+ cryptocurrencies. The platform operates since 2014 with enterprise-grade reliability (99.9% uptime SLA). Real-time prices update continuously; users can compare any cryptocurrency against Bitcoin or Ethereum for relative performance analysis.

Strengths: Completely free for core features, covers 10,000+ assets, provides historical data spanning years, includes NFT prices and trading pairs, open API available for developers.

Limitations: Advanced analytics require paid CoinGecko Pro ($10/month or $99.90/year), portfolio tracking features limited in free version.

CoinMarketCap (Free, Market Overview)

CoinMarketCap serves as the cryptocurrency equivalent of financial data aggregators. The platform covers 9,000+ cryptocurrencies with real-time prices, market capitalization rankings, volume data, and news integration. Bitcoin dominance (Bitcoin's percentage of total crypto market cap) appears prominently as a key market indicator.

Strengths: Simple interface suitable for beginners, tracks market cap rankings reliably, free price alerts available, portfolio tracking included in free plan, mobile apps for iOS/Android.

Limitations: Pricing methodology differs slightly from CoinGecko; some advanced features require CoinMarketCap Pro ($12.99/month or $95.88/year).

Merlin Crypto (Premium, Advanced Portfolio)

Merlin Crypto represents next-generation cryptocurrency tracking, designed for both retail investors and professional traders. The platform integrates with 400+ cryptocurrency exchanges and major wallets (Coinbase, Binance, Kraken, hardware wallets), providing comprehensive portfolio aggregation.

Strengths: Tracks 12,000+ digital assets, noncustodial read-only integration ensures security, exit strategy alerts enable automated selling, detailed performance analytics, 30-day free trial available, cross-platform support (iOS, Android, web).

Limitations: Full feature access requires subscription ($16.99/month with annual discounts), available primarily in US/Canada, paid model vs. free competitors.

Method 2: Mobile Applications

Mobile apps enable price tracking from anywhere, critical for traders monitoring markets during travel or business.

CoinMarketCap Mobile App

The mobile version provides push notifications for price alerts, live charts, cryptocurrency rankings, and portfolio tracking. Users can set specific price points and receive notifications when Bitcoin, Ethereum, or any altcoin reaches target prices. The interface optimizes for mobile screens with one-tap access to key metrics.

Delta (Multi-Asset Tracking)

Delta tracks cryptocurrencies alongside stocks, ETFs, commodities, and NFTs. The app connects to 300+ exchanges and wallets with automatic sync across devices (iOS, Android, desktop). Support for manual trade entry accommodates those preferring to execute and track trades independently. NFT collection tracking with floor price monitoring appeals to comprehensive portfolio managers.

Coindive (Social Sentiment + Prices)

Coindive combines price tracking with community sentiment analysis. The app monitors social media discussions, project updates, and community engagement alongside price data. Users identify trending cryptocurrencies through social signals rather than price action alone, useful for identifying emerging opportunities.

GoodCrypto (Live Screener)

GoodCrypto provides real-time cryptocurrency screener functionality tracking 8,000+ coins across 35 exchanges. The app displays 24-hour volumes, technical analysis ratings based on 17 moving averages and oscillators, and technical Buy/Sell signals. The screener helps identify coins with optimal entry/exit opportunities based on technical analysis.

Method 3: Price Alert Systems

Alert systems eliminate the need for constant monitoring by automatically notifying users when prices reach specified targets.

CoinMarketCap Price Alerts (Free)

CoinMarketCap's alert system allows absolute price-based alerts ("Notify me when Bitcoin reaches $100,000") and percentage-based alerts ("Notify me when Ethereum drops 15%"). Alerts integrate with portfolio and watchlist features, enabling quick action when conditions trigger.

TradingView Alerts (Advanced Technical)

TradingView offers sophisticated alert systems based on technical indicators (moving averages, RSI, MACD, Bollinger Bands). Traders configure custom chart-based alerts triggering when price patterns form or technical conditions are met. Webhook support enables integration with trading bots and automated systems, essential for active traders executing complex strategies.

Coinigy (Multi-Indicator Alerts)

Coinigy's alert system extends beyond price to volume-based notifications, tracking shifts in trading volume preceding major price movements. The platform monitors 300+ exchanges, supporting institutional-grade cryptocurrency analysis.

Cryptocurrency Alerting (Comprehensive Notifications)

Cryptocurrency Alerting provides 9 notification methods: push, email, SMS, Telegram, Discord, Slack, webhook, phone call, and in-app alerts. This redundancy ensures critical alerts reach users regardless of their notification preference. The platform monitors exchange listings, enabling users to catch new listings on Coinbase or Binance immediately.

Telegram Bots (Custom, Developer-Friendly)

CoinMarketCap's official Telegram bot receives /enable_hourly_price_alert commands for hourly price updates. Developers build custom Telegram bots using Python (via CoinGecko API) for personalized monitoring. Example: A Python bot checking Bitcoin every 60 seconds, alerting when price crosses $95,000 threshold via Telegram message.

Method 4: APIs for Programmatic Tracking

Developers integrate cryptocurrency prices into applications using APIs, enabling custom monitoring solutions.

CoinGecko API (Free, Comprehensive)

CoinGecko's free API provides access to 10,000+ cryptocurrencies with live and historical prices, market cap data, trading pairs, and NFT information. Over 70+ endpoints cover various data needs. No authentication required for basic endpoints; rate limits accommodate most use cases. Ideal for building cryptocurrency dashboards, creating trading bots, or populating price information on websites.

CoinMarketCap API (Freemium)

CoinMarketCap's professional API delivers real-time cryptocurrency pricing, market capitalization, trading volume, and historical data. Latest cryptocurrency pricing endpoint provides current prices for specified coins. Historical data endpoint returns OHLCV (Open, High, Low, Close, Volume) information for technical analysis.

Bitquery Crypto Price API (Advanced, Real-Time Streaming)

Bitquery provides ultra-low latency crypto price data via GraphQL and Kafka streams. The Price Index delivers pre-calculated OHLC, moving averages (SMA, WMA, EMA), and mean prices across multiple blockchains (Ethereum, Solana, BSC, Arbitrum, Polygon). Real-time streaming with 1-second granularity serves trading bots, DeFi protocols, and charting applications requiring instantaneous data.

API Ninjas Crypto Price API (Lightweight, Multiple Endpoints)

API Ninjas offers three cryptocurrency endpoints: current price (/v1/cryptoprice), historical data (/v1/cryptopricehistorical), and available symbols (/v1/cryptosymbols). Simple REST API design accommodates developers preferring straightforward, lightweight integrations.

CoinAPI (Professional Data)

CoinAPI provides unified access to cryptocurrency market data from 400+ exchanges. The platform enables building real-time pricing applications accessing multiple exchanges simultaneously, useful for arbitrage detection or comprehensive portfolio tracking.

Method 5: Blockchain Explorers for On-Chain Monitoring

Blockchain explorers reveal transaction-level data and on-chain movements, tracking actual cryptocurrency transfers beyond price data.

Etherscan (Ethereum Network)

Etherscan serves as the Ethereum ecosystem portal, displaying real-time smart contract interactions, token transfers, gas prices, and wallet activity. Users monitor specific addresses, track whale movements, verify smart contract details, and analyze DeFi protocol activities. The explorer reveals which wallets are accumulating or distributing cryptocurrencies, providing insights into institutional or whale behavior.

Blockchain.com (Bitcoin Tracking)

Blockchain.com tracks Bitcoin transactions, mempool status, block generation, mining activity, and exchange flows. Real-time monitoring shows Bitcoin moving into/out of exchanges, indicating buying/selling pressure. The explorer reveals address clustering, helping identify exchange wallets vs. private holdings.

Tokenview (Multi-Chain, Real-Time Network Data)

Tokenview monitors Bitcoin, Ethereum, Litecoin, and 15+ additional blockchains. Real-time network metrics include transaction count, hash rate, block size, and transaction fees. Users view wallet transaction history, analyze market trends, and track on-chain movements across multiple networks simultaneously.

BlockCypher (Analytics & Visualization)

BlockCypher provides comprehensive analytics with visualizations (graphs, charts, heatmaps) of blockchain activity. The explorer supports Bitcoin, Litecoin, Dogecoin, and Ethereum, useful for understanding cryptocurrency ecosystem health and identifying anomalous transaction patterns.

Method 6: Advanced Monitoring for Active Traders

Professional traders employ sophisticated monitoring combining multiple tools for competitive advantage.

TradingView Charts (Professional-Grade)

TradingView provides institutional-quality charting with real-time price updates, technical indicators, drawing tools, and alert systems. Traders identify support/resistance levels, chart patterns, trend reversals, and optimal entry/exit points. Community feature shares trading ideas and analysis; script capability enables custom indicators.

Live Coin Watch (Volume & Liquidity)

Live Coin Watch aggregates prices and liquidity across exchanges, displaying order book depth, bid-ask spreads, and volume concentration. Traders identify least liquid cryptocurrencies (wider spreads, greater slippage risk) vs. most liquid (tighter spreads, instant execution). The platform helps optimize execution by routing to highest-liquidity exchange for specific trading pair.

Coindi.ve (AI-Powered Smart Alerts)

Coindive's AI-powered alerts contextualize price movements, connecting them to relevant market events. Rather than simple price notifications, users receive insights explaining why price moved (regulatory news, institutional activity, exchange listing, whale activity). This analysis helps distinguish genuine opportunity from random volatility.

India-Specific Price Tracking Considerations

Indian cryptocurrency investors face unique regulatory and operational challenges affecting price tracking strategy.

RBI Regulation Impact:

The Reserve Bank of India discourages cryptocurrency but hasn't outright banned it. RBI policy affects which exchanges remain operational, which tracking platforms serve Indian users, and whether rupee-to-crypto on-ramps function reliably. Using regulated Indian exchanges (Kraken India, Giottus, CoinDCX, Zebpay) ensures tracking data reflects actual INR conversion rates rather than theoretical USD prices.

Rupee Conversion Rate Variability:

Bitcoin's USD price and INR price don't move perfectly in sync due to rupee volatility. When rupee weakens, Bitcoin becomes more expensive in rupees despite flat USD prices. Indian investors must track both: BTC/USD price and BTC/INR price, calculating rupee impact separately from cryptocurrency price movement.

Time Zone Considerations:

Markets operate 24/7, but Indian trading hours concentrate activity 8 AM-8 PM IST. Global price discovery happens continuously; Indian investors catching early movements (4 AM-8 AM IST) when US/European markets trade actively can identify opportunities before Indian market opens.

Exchange-Specific Premiums:

Smaller Indian exchanges sometimes show 3-5% premiums/discounts to global prices due to limited liquidity and regulatory constraints. Tracking prices across multiple Indian platforms (Kraken India, Zebpay, CoinDCX) reveals these discrepancies, enabling profitable arbitrage or identifying overpriced/underpriced opportunities locally.

Setting Up an Effective Monitoring System

Successful cryptocurrency price tracking combines multiple tools aligned with investment objectives.

For Casual Investors (Checking Prices Weekly/Monthly):

Use CoinGecko or CoinMarketCap web interfaces, set 1-2 portfolio watchlists, check monthly during portfolio review. Mobile app installed for occasional spot-checking. No alerts necessary; passive observation sufficient.

For Active Investors (Checking Prices Daily):

Download CoinMarketCap or Delta mobile app, set 5-10 price alerts on strategic cryptocurrencies, enable push notifications. Set alerts at psychologically significant levels (round numbers: $100,000, support/resistance: previous highs/lows). Check portfolio twice daily (morning/evening IST).

For Day Traders (Monitoring Continuously):

Subscribe to TradingView Professional or Merlin Crypto for advanced charting and analytics. Use multiple alert systems simultaneously (TradingView alerts, Telegram bot, exchange native alerts) for redundancy. Monitor order book liquidity on Live Coin Watch. Set up custom Python bot via CoinGecko API for proprietary technical analysis. Check portfolio continuously during trading hours.

For Algorithmic Traders (Building Automated Systems):

Integrate Bitquery or CoinMarketCap APIs into trading bot infrastructure. Implement low-latency price feeds for sub-second decision-making. Set up Webhook alerts triggering automated trading responses. Monitor on-chain data via Etherscan/Blockchain.com for liquidity changes. Deploy comprehensive monitoring across Telegram, Discord, email with redundant alerting.

Potential Challenges and Solutions

Challenge 1: Information Overload

Tracking too many cryptocurrencies generates alert fatigue, causing important signals to be ignored. Solution: Limit watchlist to 5-10 core holdings plus 3-5 growth opportunities. Concentrate alerts on critical price levels rather than all minor movements.

Challenge 2: Exchange Pricing Discrepancies

Cryptocurrency prices differ across exchanges due to liquidity, geographic arbitrage, and regulatory constraints. Solution: Use aggregated platforms (CoinGecko, CoinMarketCap) showing volume-weighted averages across multiple exchanges. For trading execution, verify prices on your specific exchange before entering orders.

Challenge 3: API Rate Limits

Free API tiers impose request limits, potentially disrupting automated monitoring. Solution: Cache price data locally, implement request batching, or upgrade to paid API tiers for production systems requiring high-frequency updates.

Challenge 4: Alert Notification Delays

Push notification delays can be 30+ seconds behind actual price movement during volatile markets. Solution: Combine push alerts with redundant methods (email, SMS, Telegram, Discord, webhook). Accept that alerts are confirmations after movement, not real-time price triggers.

Challenge 5: Mobile App Reliability

Push notifications sometimes fail; apps crash during high-volume events. Solution: Set up multiple alert systems independently (different platforms, notification methods). Don't rely solely on a single app for critical trading decisions.

Building Your Cryptocurrency Monitoring Framework

Real-time cryptocurrency price tracking in 2025 requires systematic approach combining multiple tools appropriate to your investment style. Casual investors benefit from simple platforms (CoinGecko, CoinMarketCap), while active traders require advanced systems (TradingView, Merlin Crypto, blockchain explorers, APIs). The most effective monitoring integrates multiple data sources: aggregated price platforms, exchange-specific prices, on-chain metrics, and technical analysis tools.

Success in cryptocurrency investing depends increasingly on information quality and responsiveness. Prices move continuously across 24/7 markets; delayed information becomes obsolete instantly. By implementing systematic monitoring aligned with your specific investment objectives, you capture opportunities, execute protective stops, and make informed decisions based on comprehensive market data rather than incomplete information.

Comments 0

Most Read

What Is the Concept of Tokenization in Blockchain?

Bitcoin & Ethereum Market Momentum Update

Recommended Post

What Is the Concept of Tokenization in Blockchain?

How Do I Avoid Common Mistakes When Trading Cryptocurrencies?

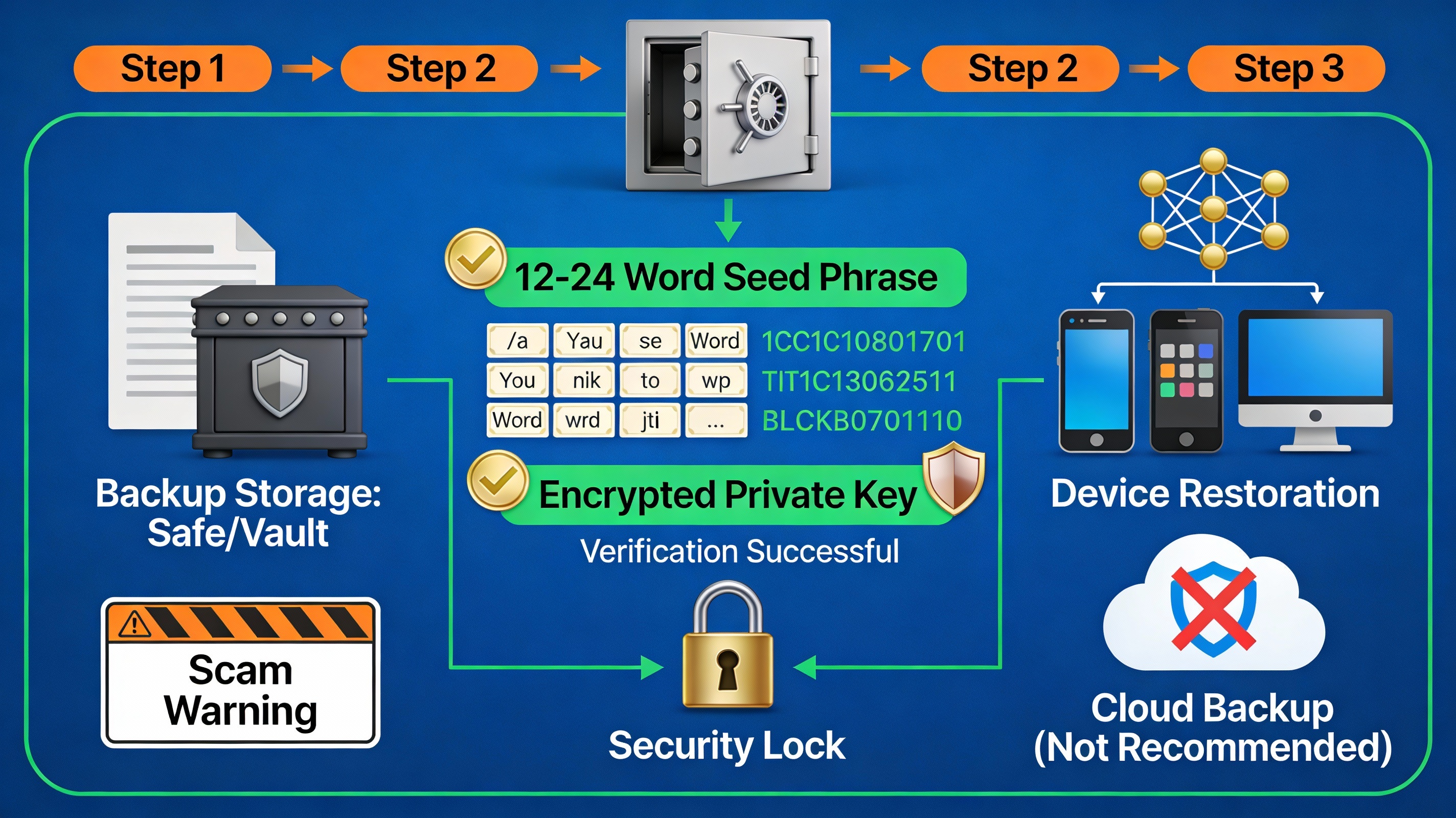

How Do I Recover a Lost Cryptocurrency Wallet?

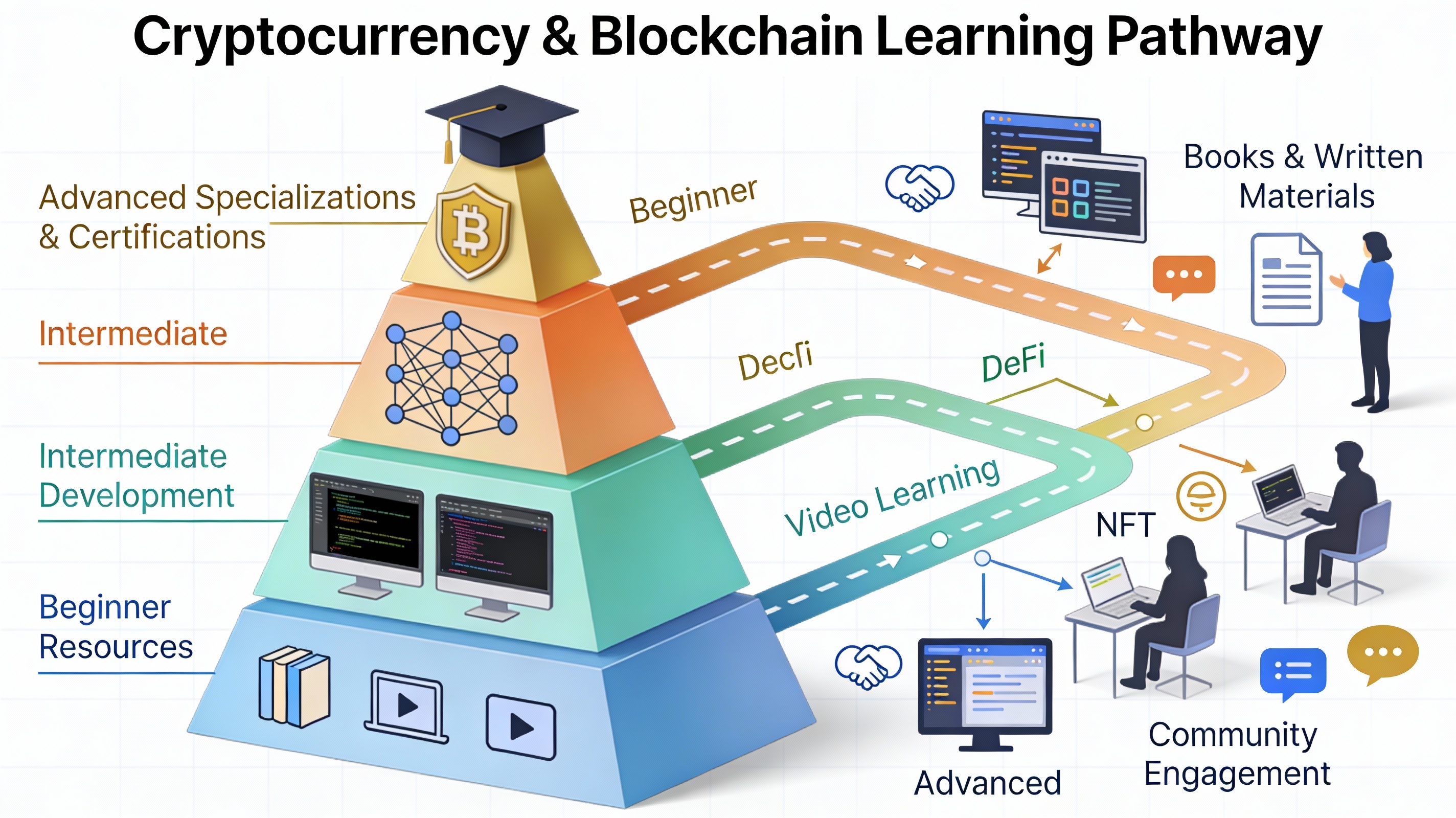

How Can I Learn More About Cryptocurrency and Blockchain Technology?

How Do I Track Cryptocurrency Prices in Real-Time?

Leave a Comment